Creating and editing Payment Proposals using a Template

This article explains how to create and edit payment proposals if the necessary master data is available in the system.

Payment Proposal Templates

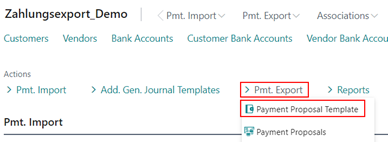

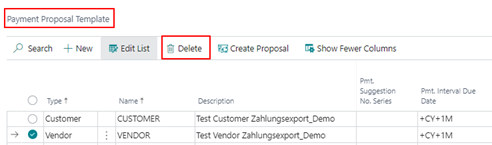

The Payment Proposal Templates menu item allows you to create a payment proposal from existing templates or create a new template directly from the Role Center.

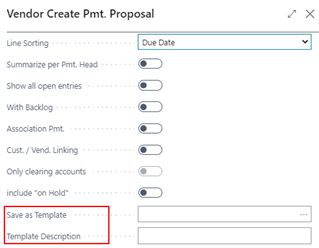

The most convenient way is to create a new payment proposal template directly from a payment proposal. For details, please refer to the Customer Create Pmt. Proposal, Vendor Create Pmt. Proposal or Empl. Create Pmt. Proposal articles. However, it is also possible to define a payment proposal template manually.

The following table describes the field entries for creating a payment proposal template:

| Option | Description |

|---|---|

| Type | In this field, you must select the type Customer, Vendor, G/L Account or Employee. |

| Name | You must enter a short identifier in this field. The value may be a maximum of 8 characters long. |

| Description | You can enter a description in this field. The value may be a maximum of 50 characters long. |

| Pmt. Suggestion No. Series | Here you have the possibility to define a different number series for the payment proposals created with this template. This different number series is optional and, if filled, has priority over the stored number series in the payment export facility. |

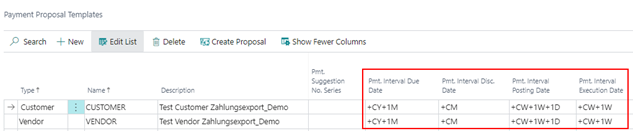

| Pmt. Intervall Due Date | At this point, you specify a date formula that will be used to calculate and propose the due date in the payment proposal to be created. |

| Pmt. Intervall Disc. Date | At this point, you specify a date formula that will be used to calculate and propose the discount date in the payment proposal to be created. |

| Pmt. Intervall Posting Date | At this point you specify a date formula that will be used to calculate and propose the posting date in the payment proposal to be created. |

| Pmt. Intervall Execution Date | At this point you specify a date formula that will be used to calculate and propose the execution date in the payment proposal to be created. |

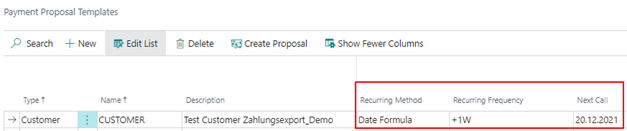

| Recurring Method | In the field Recurrence type you have the options Date formula or Target calendar to choose from. Here you define whether the date of the next payment proposal is to be determined by date formula or by target calendar. If you use the Target calendar, the system automatically presets the next debit or transfer date for customers and vendors according to the Target calendar setup. A date formula is used according to the user setup made. |

| Recurring Frequency | If you select the Date formula option as the recurrence method, fill the "Recurring Frequency" field with a date formula. For example, if you want to create a weekly payment proposal, set up "+1W". |

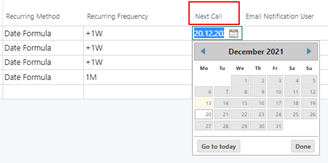

| Next Call | The "Next call" field will be filled automatically after creating a payment proposal from this template according to the date formulas setup made. This field is crucial for the automatic creation. The user has the possibility to override this field manually. |

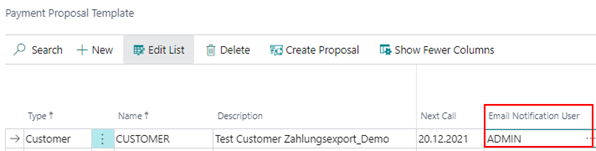

| Email Notification User | Select a user here who should be notified by mail when a payment proposal has been created via the corresponding template and has been made available for editing. |

| Discountoption | At this point, an option for the cash discount calculation is stored for this template. The following options are available: Always Discount, As Entered, Always in Period or None discount. |

| Account Type | In this field you must enter the corresponding account type of the counterpart photo with which a payment proposal is to be created. As a rule, this is the "Bank account" option. However, the option "G/L Account" is also available for selection. |

| Account No. | In this field you have to enter a bank account number which should appear as default value in the payment proposal if "Bank account" has been selected as account type. If the account type "G/L Account" is used, the account numbers of the G/L chart of accounts are available here. |

| Use Payment Type Code | If you predefine a payment type code here, this will be entered for all payments of the payment proposal instead of the payment type code assigned in the entry via the payment method. |

| Summarize per Pmt. Head | If this field is activated, only one entry will be created per payment proposal header on the account entered in the "General" tab and not one entry per balanced entry. This selection can still be changed when calling up a new payment proposal. It should be noted when using this option that no dimensions from the individual entries are included in an associated discount amount posting. |

| Include All | If this field is activated, the application will display all open entries of a customer/vendor in a payment proposal and not only the entries that are due for payment. The due entries will be automatically marked for payment (the clearing will be set), the other entries will be initially unmarked and can be manually selected for payment. |

| With Backlog | If this field is activated, in a payment proposal via this template also person accounts will be proposed, where due to the due entries in total there is an overpayment (= a backlog). |

| Association Payment | This option is only available if the module "OPplus Associations" has been licensed. If this field is activated, all customers or vendors belonging to an association will be considered with their due entries in a payment proposal via this template. |

| Cust. / Vend. Linking | This option is only available if the module "OPplus Associations" has been licensed. If this field is activated, also the due entries of the related customer or vendor from a corresponding customer/vendor linking will be considered in the created payment proposal. |

| Only settled Accounts | As soon as a debit-side/credit-side or credit-side/debit-side settlement is to take place via a payment proposal with this template, this option can be selected additionally. OPplus will then only create a payment proposal for all customers or vendors that belong to a group. Other customers or vendors will not be considered. For this setting to be effective, the "Association Pmt." and "Cust./Vendor Linking" fields must also be activated. |

| SEPA Due Date at Direct Debit | If this field is activated, the set up SEPA due dates will be taken into account for a direct debit via this payment proposal template. This value may override the basic setup of the payment export setup. |

| Include On Hold | If this option is selected, entries marked "On Hold" will still be included in the payment proposal via this template. However, these items will not be marked for clearing and will therefore continue to be marked in black. |

| Account Filter 1 | This field shows you the last used filter of the Customers or Vendors tab for this template. If the value is > 250 characters, further values are written into the Account Filter 2 to 4 fields. |

| Ledger Entry Filter 1 | This field shows you the last used filter of the Customer Ledger Entries or Vendor Ledger Entries tab for this template. If the value is > 250 characters, the Ledger Entry Filter 2 field will be filled accordingly. |

On the payment proposal templates page, appropriately selected templates can also be deleted.

Creation of Payment Proposal from Payment Proposal Template

First of all, it is necessary to set up and check the created templates. A debit-side or credit-side payment proposal to be created can be saved as a template accordingly via the "Create Pmt. Proposal" and "Save as Template" functionality.

If templates on payment proposals have been generated, they should be checked in relation to the intervals to be performed.

According to these intervals, the corresponding date values are calculated when creating a payment proposal. If the intervals are not set up, the values from the payment export setup in the "Create Pmt. Proposal" tab or the respective working date apply.

If the payment proposals are to be processed automatically via a task queue, the following values must be set up:

- Recurring Method

- Recurring Frequency

- Next Call

The information is processed in a corresponding task queue. The system can independently determine whether a payment proposal needs to be executed again or not.

In the Recurrence Method field, you can choose between the Date Formula or Target Calendar options. If you use the Target Calendar, the system will automatically find the next debit or credit transfer date for customers and vendors according to the Target Calendar setup.

A date formula is used according to the user setup in the payment proposal. If you select the Date formula option, you should also fill in the "Recurrence Frequency" field accordingly. For example, if a payment proposal is to be created weekly using a specific template, set up "+1W".

The "Next call" field is automatically filled after the creation of the corresponding payment proposal, according to the set up recurring frequency. This field is then decisive for the automatic creation via the task queue. The user has the possibility to override this field manually.

Payment Proposal as Batch

A code unit that processes all due payment proposal templates will be provided to you by OPplus for a corresponding batch run.

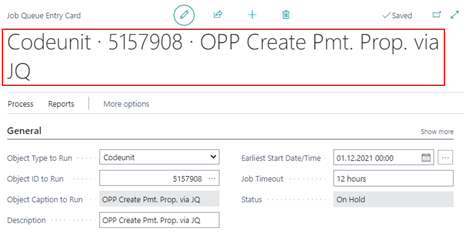

In the ID area of OPplus the code unit 5157908 - OPP Create Pmt. Proposal via JQ is used. If you include this codeunit in the job queue, all payment proposals due according to the payment proposal template will be executed. For this, the recurring method must be filled in as described and the work date must be greater than or equal to the value specified in the "Next Call" field.

Email Notification for Payment Proposal Templates

You also have the option to define a user in a payment proposal template who should be notified when a payment proposal has been generated via this template.

This functionality is also used when the payment proposal is processed through a job queue.

Depending on the Business Central version, it may be necessary to set up the SMTP setup in order to use this function. If this setup is not available, the user will receive an error message directly upon selection. In a SaaS environment, corresponding e-mail accounts should have been created via the standard "Email Notification User" function.

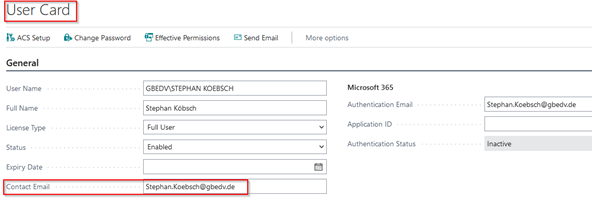

From the respective selected user, the following field is used for the generated e-mail:

The e-mail generated by the creation of the payment proposal is a system e-mail, the content of which is not to be set up.