Payment Export Switzerland

The module Payment Export CH of the certified solution OPplus implements the national Swiss specifics for outgoing payments according to the standard format ISO 20022 with the following payment types:

CH-ISO CHF (CH-ISO 20022 CT in CHF)

CH-ISO EUR (CH-ISO 20022 CT in EUR)

CH-ISO FCY (CH-ISO 20022 CT in foreign currency)

In addition, the following ISO 20022 formats for direct debits will be implemented for Postfinance:

CHISODDCHB (B2B Direct debit in CHF with Postfinance)

CHISODDCHC (CORE Direct debit in CHF with Postfinance)

CHISODDEUB (B2B Direct debit in EUR with Postfinance)

CHISODDEUC (CORE Direct debit in EUR with Postfinance)

Also included is the direct debit procedure (LSV) implemented by the OPplus payment type:

- CH-LSV

Historically, also included is the national Swiss DTA payment format for outgoing payments with the following transaction types (TA):

CH-ESR (TA826 ESR payments)

CH-CHF (TA827 CHF payments domestic)

CH- FW (TA830 foreign payments in CHF and foreign currency, also domestic payments in foreign currency)

CH-IBAN (TA 836 payments with IBAN domestic and foreign countries, all currencies)

As well as direct debit for Postfinance implemented through the payment type CH-DD.

Tip

The historically included payment formats are no longer accepted by banks, therefore the associated payment types are set to inactive. Thus, these payment types are no longer displayed in the overview and are also no longer available as an option in the drop-down fields.

Note

To create correct payment files when using the Payment export CH module, you have to predefine certain fields in the master data, or, in the case of payments with ISR code line or QR code, you have to enter certain data when posting.

In the following, only the fields and functions are described that are used exclusively for the Payment export CH module. For all other basic functions, please refer to the manual for the Payment export module.

Necessary Bank Account Data

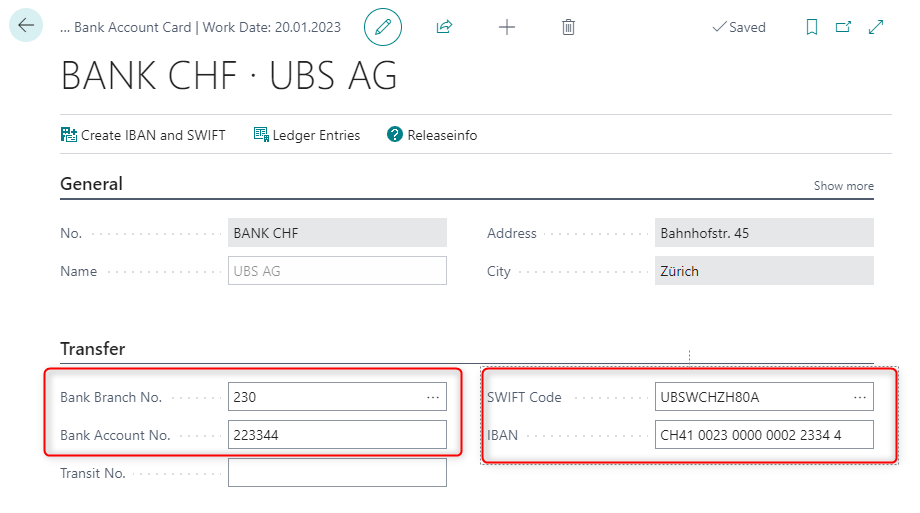

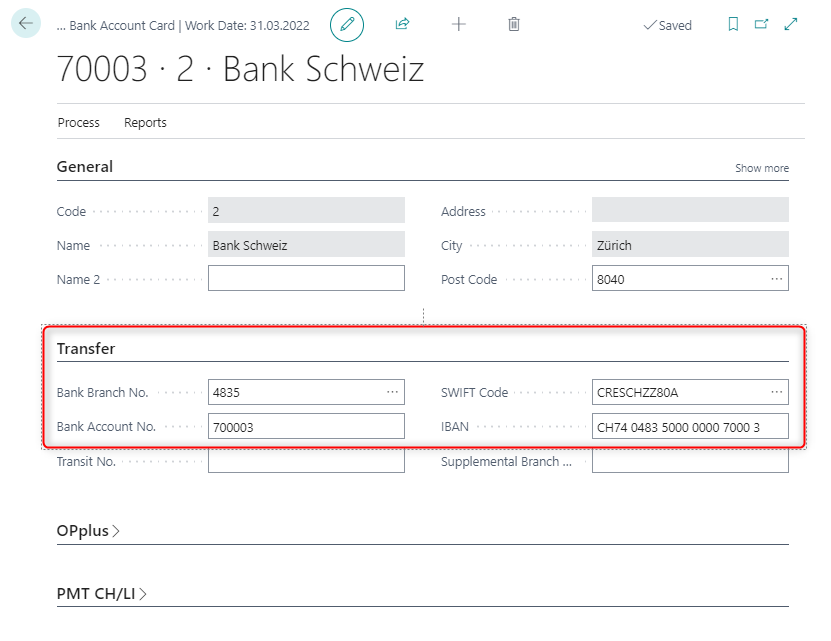

Bank Account (Orderer Bank)

The orderer bank account should be held at a Swiss credit institution and have the country code 'CH' or 'LI' if the client does not have the country code 'CH' or 'LI'. Also, a valid combination of BLZ and account number and/or BIC/SWIFT code and IBAN should be stored.

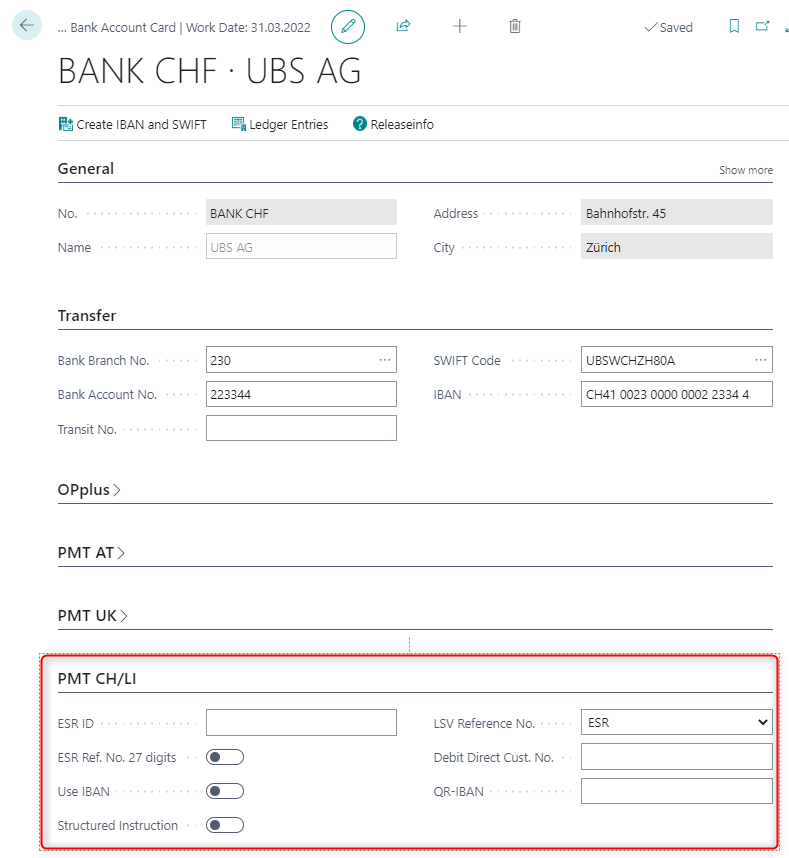

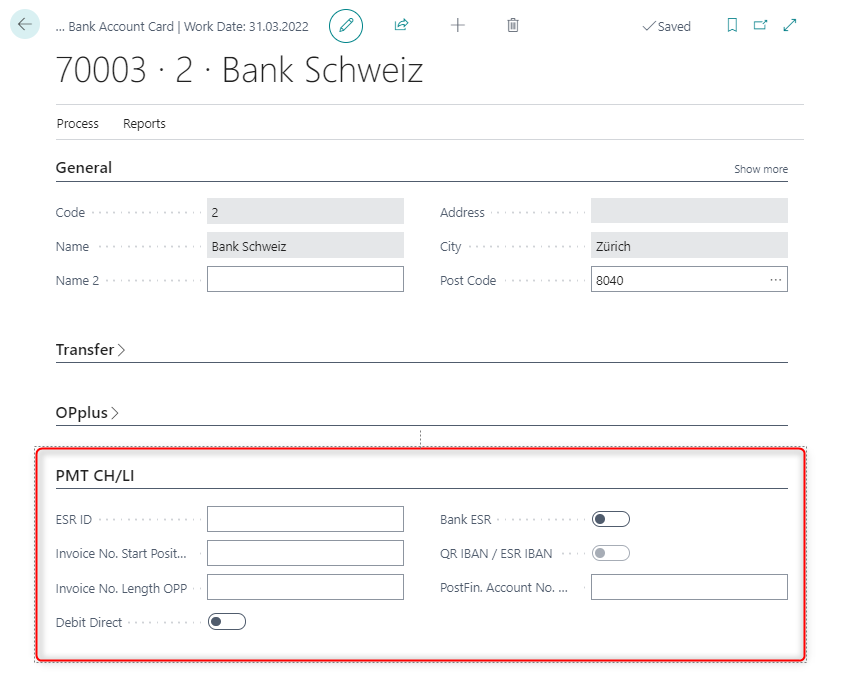

The register ZV CH/LI is available, especially for the module Payment transactions CH/LI:

| Option | Description |

|---|---|

| ESR-ID | Enter your ESR ID here if you participate in the ESR procedure. This ID is necessary for the payment type CH-ISO CHF. |

| ESR Ref. No. 27 digits | Activate this option if you participate in the ESR procedure with a 27-digit reference number. |

| Use IBAN | Activate this option if you want your IBAN to be transmitted in the DTA file instead of your account number. |

| Structured Instruction | Activate this option if structured instructions are to be transmitted. You can then enter the instruction codes in the payment proposal header. |

| LSV Reference No. | This field is relevant for the payment type CH-LSV. Here you can choose which type of reference number should be transferred in the data medium. You can choose between the options ESR and IPI (=International Payment Instruction). Depending on the selection, the reference number is built by the program before the data medium is created and logged in the payment proposal line. The ISR reference number is built from "ESR ID" and document number of the invoice. The IPI reference number is built from the document number of the invoice. |

| Debit Direct Cust. No. | This field is relevant for the payment type CH-DD. You enter your Debit Direct customer number here. |

| QR-IBAN | Please enter the QR-IBAN code here if it differs from the QR-IBAN code in the setup. |

Necessary Customer Master Data

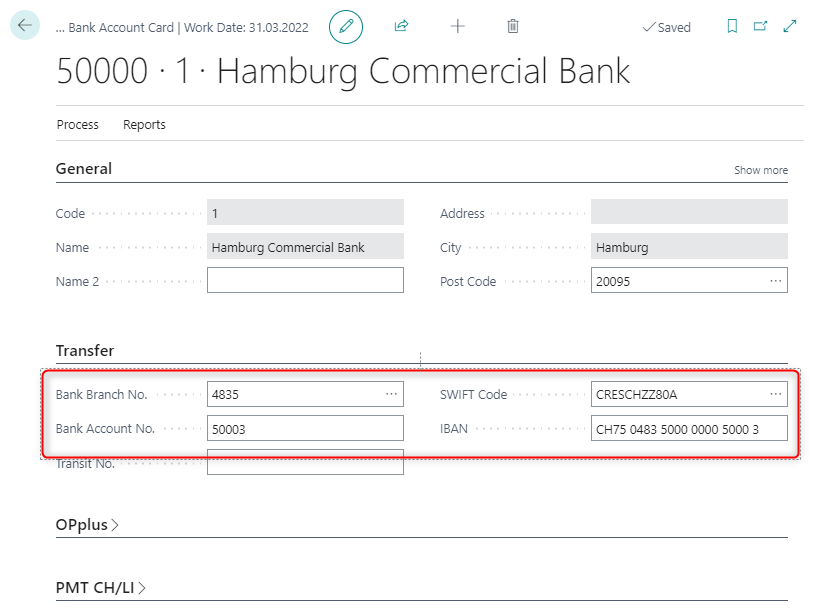

Customer Bank Account Card

Enter a valid combination of bank branch code and account number and/or BIC/SWIFT code and IBAN.

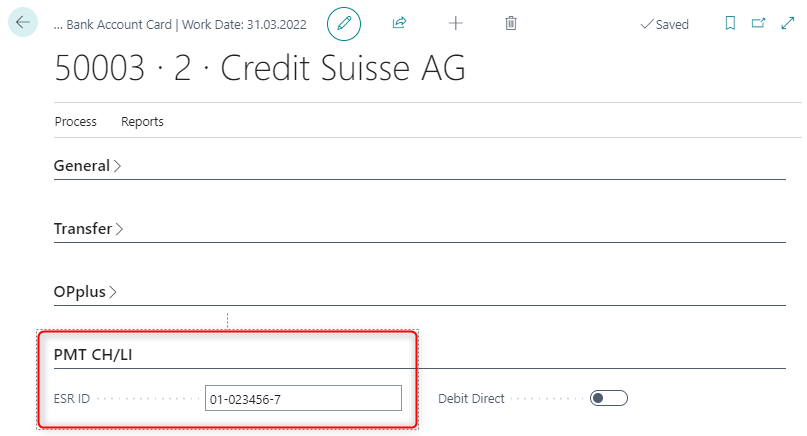

Especially for the Payment Export CH/LI module, two additional fields are available in PMT

CH/LI:

| Field in Customer Bank Account Card | Description |

|---|---|

| ESR ID | Enter the ESR ID of the customer here if the customer participates in the ESR procedure. |

| Debit Direct | This field is activated by the program to indicate if the bank account number entered is a Post Finance bank account. |

Necessary Vendor Master Data

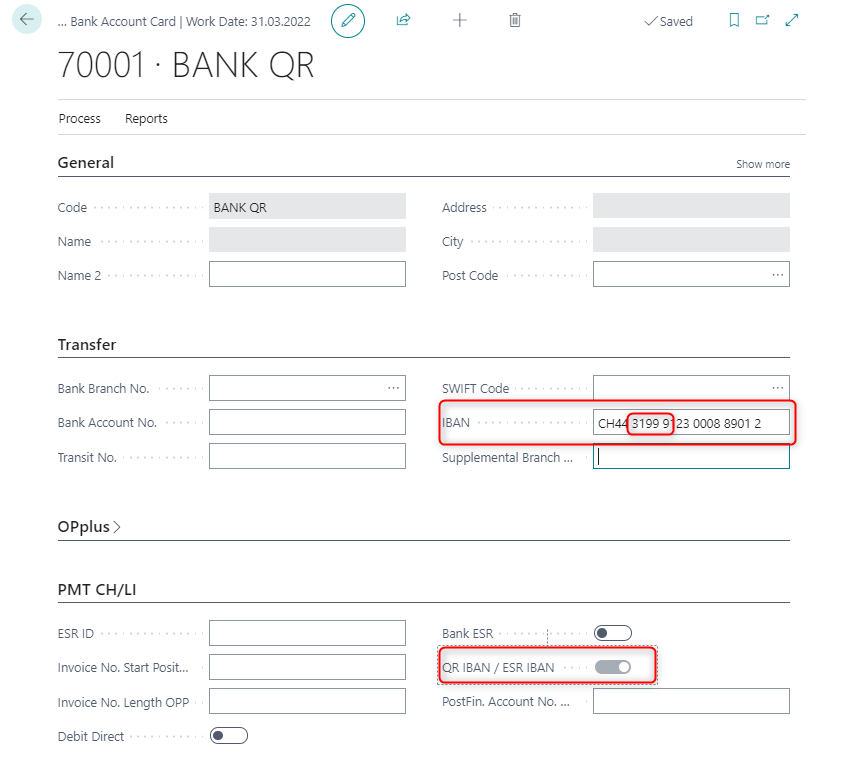

Vendor Bank Account Card

Enter a valid combination of bank branch code and account number and/or BIC/SWIFT code and IBAN.

Especially for the Payment Export CH/LI module, two additional fields are available in PMT CH/LI:

| Field in Vendor Bank Account Card | Description |

|---|---|

| ESR ID | Enter the ESR ID of the customer here if the customer participates in the ESR procedure. |

| Debit Direct | This field is activated by the program to indicate if the bank account number entered is a Post Finance bank account. |

| Bank ESR | This field is currently not in use. |

| Invoice No. Start Position | Enter here the start position of the invoice number within the coding line. From here on, the invoice number will be extracted from the coding line according to the configured length and entered accordingly in the "Credit invoice no." field. |

| Invoice No. Length OPP | Enter the length of the invoice number. |

| QR-IBAN / ESR-IBAN | This field is automatically set if the IBAN is a QR-IBAN/ESR-IBAN. |

Setup Pmt. Export CH

Before you can work with the module, you must create the setup data. This is done in the Pmt. Export Setup CH, which you can access via Setup Import / Export > More Pmt. Exports > Pmt. Export Setup CH > Create setup data.

General FastTab

| Field | Description |

|---|---|

| Currency Code CHF | CHF is entered here as the code for Swiss francs. |

| Currency Code Euro | Enter here the ISO currency code for Euro (EUR), this field is currently not in use. |

| Country Code Schweiz | Enter here as country code, the code that represents Switzerland in the country table, usually CH. |

| Country Code Liechtenstein | Enter here as country code, the code that represents Liechtenstein in the country table, usually LI. |

| Homepage SIX | By creating the setup, data was entered that links to the homepage of the SIX Group. This site provides useful information about payment formats, and it also offers the option to download the Swiss bank master. |

DTA FastTab

| Field | Description |

|---|---|

| DTA Orderer | Here you can enter your DTA orderer ID, this field is currently not in use. |

| DTA Sender | Enter your 5-digit DTA sender ID here, the entry will be transferred to field 20: of the DTA file together with a sequential number. |

| LSV Sender ID | Enter your 5-digit LSV sender ID here, the entry will be transferred to the ABS ID and LSV ID fields of the LSV file. |

| ID Invoicing Party ID (RS-PID) Postfinance | This field is required for the use of direct debits. You enter the Invoicing Party ID (RS-PID) here. |

| LSV Create Test Files | Activate this option if you want to test the LSV procedure first, the created LSV file will then be marked with a test flag. |

| Max. Amt. CHF | This field is used for payment type CH-DD, enter here the max. amount in CHF per payment proposal header. |

ESR Printing FastTab

| Field | Description |

|---|---|

| ESR Customer-ID CHF | Enter your ESR customer ID for CHF here, this customer ID will be printed on the ESR payment slip. |

| ESR Member No. CHF | Enter your ISR participant number for CHF here, this participant number will be printed on the ISR payment slip. |

| ESR Bank City | Enter the city of your ESR Bank here. |

| ESR Bank Name | Enter the name of your ESR Bank here. |

| ESR Customer-ID EUR | Enter your ESR customer ID for EUR here, this customer ID will be printed on the ESR payment slip. |

| ESR Member No. CHF | Enter your ESR participant number for CHF here, this participant number will be printed on the ESR payment slip. |

| Upper Border | ESR payment slips have a predefined layout. You can position the print exactly with the help of the Upper margin field. |

QR Printing FastTab

| Field | Description |

|---|---|

| Version QR Code Specification | The program enters the current QR code specification (currently "SPC02001") in this field. |

| Default Reference Type | If different reference types are possible, you can enter the reference type that occurs most here. You can set up the reference types under Reference Type Institution. |

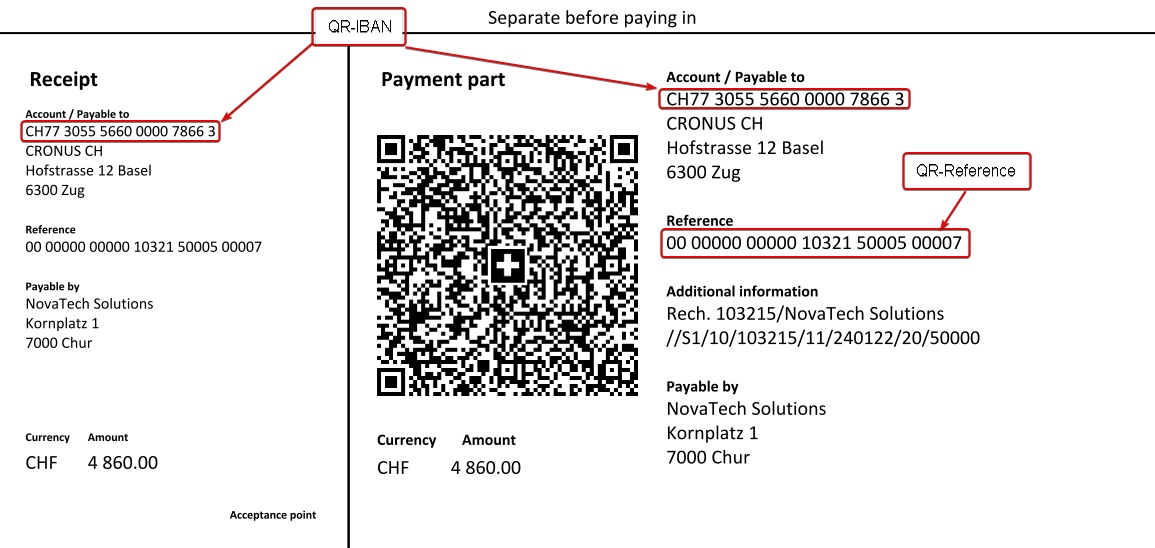

| QR-IBAN | Enter your valid QR-IBAN here. Separate QR-IBAN accounts with a special IID from 30000 to 31999 are used for the QR procedure. |

| Calc QR Reference No. like ESR Reference No. | Activate this option if the QR reference number is to be calculated like the ESR reference number. Otherwise, the QR reference is generated from a number series starting with 1. If you import the CAMT bank statements via OPplus Pmt. Import, it is necessary to activate this field to ensure automatic allocation. |

| Last used Reference No. | This field displays the last QR reference number used. This field is only filled if the QR reference number is generated via the number series. If "Calculate QR reference number like ISR reference number" is activated, this field is not used. |

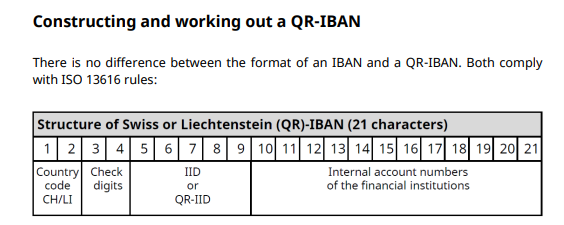

Constructing a QR IBAN

QR IDD in the range 30000 - 31999

Note

For the QR-IBAN structure, see https://www.paymentstandards.ch/dam/downloads/qr-iid_qr-iban-en.pdf

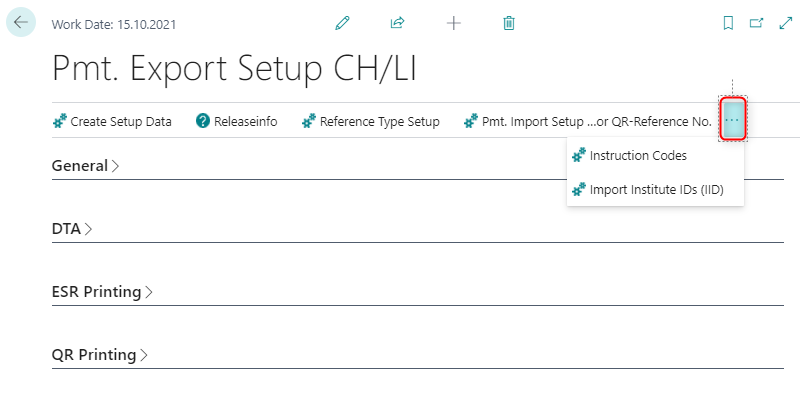

Additional Functionalities

You will find additional functionalities in the Pmt. Export Setup CH/LI for additional functionalities:

Reference Type Setup is relevant for printing QR invoices.

Pmt. Import Setup for ESR or QR reference numbers refers to the allocation of open items in the OPplus Pmt. Import.

Instruction Codes refers to the payment type CH-FW and is no longer required.

With Import Institute IDs (IID) you can import the bank master data (Bank Branch Code) for Switzerland.

Payment Types

By creating the setup data, the following payment methods are additionally available to you for transfers:

CH-ISO CHF CH-ISO 20022 CT in CHF

CH-ISO EUR CH-ISO 20022 CT in EUR

CH-ISO FCY CH-ISO 20022 CT in foreign currency (all except CHF and EUR)

For direct debit, the following payment methods are available:

CH-LSV LSV Bankenclearing

CHISODDCHB B2B Direct debit in CHF with Postfinance

CHISODDCHC COR1 Direct debit in CHF with Postfinance

CHISODDEUB B2B Direct debit in EUR with Postfinance

CHISODDEUC COR1 Direct debit in EUR with Postfinance

The new payment types mentioned here are only for payments and direct debits within Switzerland and Liechtenstein. Please use SEPA for payments in the EUR area and ISO PMT for foreign payments.

ISO 20022

With the payment types CH-ISO CHF, CH-ISO EUR and CH-ISO FCY, the ISO-20022 payment file for transfers in Switzerland is basically configured. This means that domestic payments can be executed according to the interface configuration even without further setups in the tables "Payment Schemas Orderer Bank" and "Pmt. Transactions Schemas". However, these can be consulted at any time for further settings if bank-specific settings are necessary.

In contrast to the general ISO 20022 format and SEPA, all of the following bank account identification fields are currently available within CH/LI:

- IBBAN (Basic Bank Account Number)

IBAN

IID (Institution identification, formerly bank clearing number or Bank Branch Code)

BIC

If necessary, the ESR ID and ESR reference number must be added.

Namespaces Payment Schemes

The values for XML namespaces for Switzerland valid as of February 2021 are:

Document XMLns:

http://www.six-interbank-clearing.com

xmlns:xsi

http://www.w3.org/2001/XMLSchema-instance

xsi:SchemaLocation:

http://www.six-interbank-clearing.com/de/pain.001.001.03.ch.02.xsd pain.001.001.03.ch.02.xsd

Foreign Payments

Payments with SEPA will still be executed with the OPplus payment type SEPA and are not subject of this manual. You will find this description in the manual Pmt. Export. Foreign payments outside the SEPA area can be executed with the payment type ISO PMT with the OPplus Pmt. Export. The country-specific configuration options required can be found in the manual for OPplus Pmt. Export.

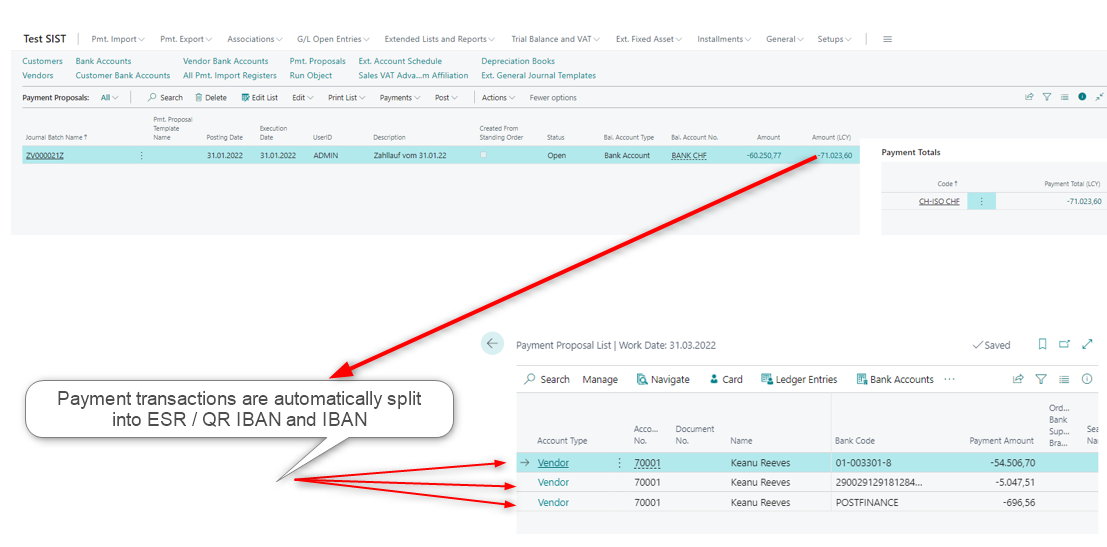

Entering Vendor Purchase Invoices with Reference Number

When entering an invoice, it is possible to enter the reference number via a QR code or an ESR reference number so that you can refer to it when making a payment. Please note that in the case of file output, the transactions are divided according to the type of reference; in the case of payments by payment slips or QR code, the corresponding reference number is transferred - instead of the purpose text. This means that credit notes and invoices cannot be mixed in such a payment.

Entering Vendor Purchase Invoices with QR Code

You can select Scan QR Bill and Import Scanned QR Bill File to import QR raw data on incoming invoice documents as well as purchase journals.

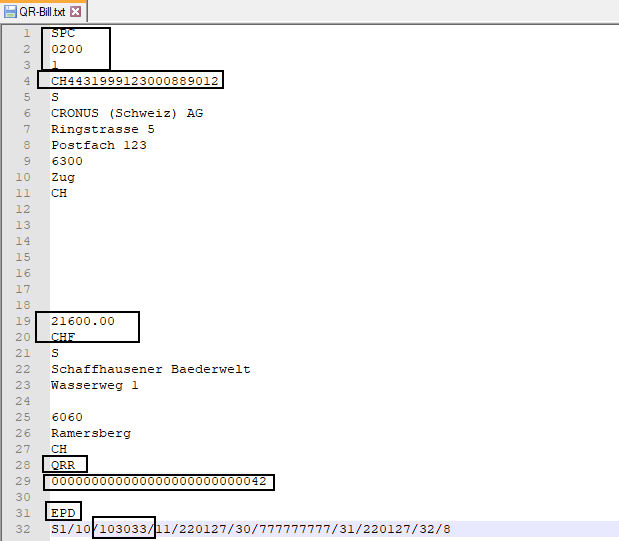

Structure QR raw data

The QR raw data has the following structure:

Line 1-3

Contains the QR Code version. This is matched with the QR Code Specification field from the facility.

Line 4

Contains the QR-IBAN of the vendor. When reading in, it is checked whether this is a valid QR-IBAN. If no vendor bank account with this QR-IBAN has yet been created for the vendor, it will now be created. The field Code is filled with the QR-IBAN, without the country code.

For versions less than or equal to NAV2016, the 5-digit QR IID from the QR IBAN is used for this.

If there is a vendor bank account with the QR-IBAN, the vendor from this vendor bank account is taken over into the document.

Line 19-20

Contain amount and currency. Both fields are transferred to the invoice. The amount in the field "Amount QR Code / ESR Coding Line".

Line 28

The value "QRR" indicates that the following line is a QR reference. Only QR references can be processed!

Line 29

Contains the 27-character QR reference, this is transferred to the "Payment Reference" field (ID171).

(Versions less than or equal to NAV2013, field "Customer data" (ID 5157960)

Line 31

EPD (End Payment Data) value to be fixed, which must occur exactly as specified.

Line 32

If the additional information is in Swico format, the invoice number can be found after the constant /10/ and is then transferred to the field Vend-Invoice no. (ID 68).

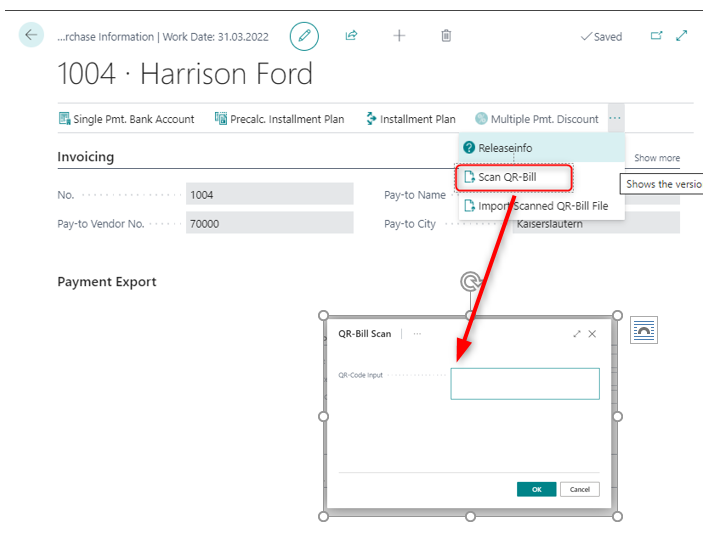

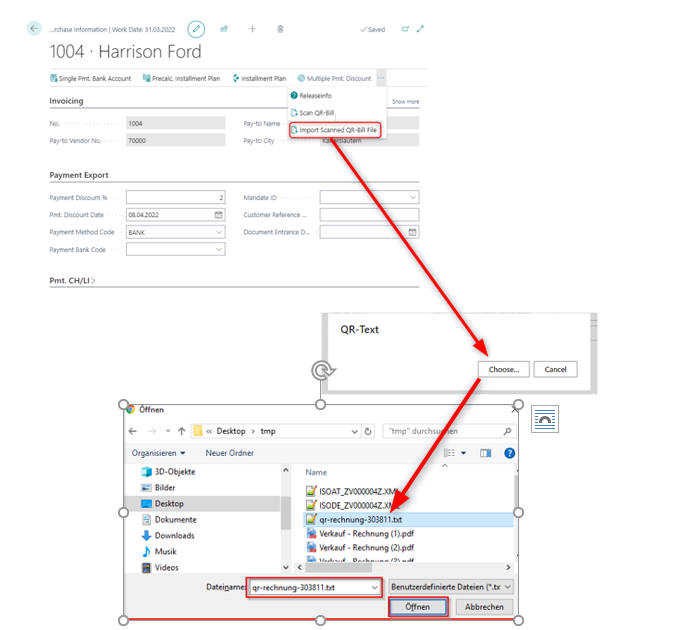

Purchase invoice document

First, create a new purchase invoice, at least the preliminary invoice number must be filled to be able to branch to the purchase information page via the OPplus button. A vendor does not necessarily have to be entered. The OPplus purchase information page can be found under More options > Related > Invoice > OPplus.

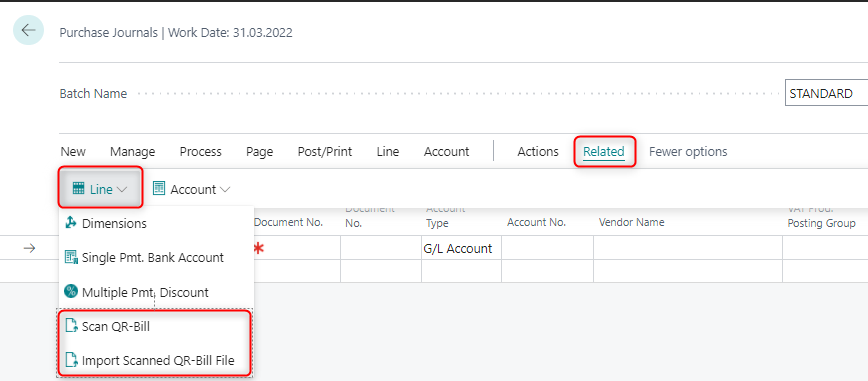

Purchase Journals

The functions Scan QR Bill and Import Scanned QR Bill File are available in the purchase journals via Related - Line.

After inserting a new purchase journal line, it must also be defined that it is a vendor entry, change the account type or balance account type to vendor.

The value from line 19 is taken over here into the field "Amount" (ID 13) of the purchase journal line. The identified invoice number from line 32 into the field "External Document Number" (ID 77).

Enter QR Code

Scan QR-Bill

The QR code raw data can be imported via the clipboard (or scanner) using "Scan QR Bill".

Import Scanned QR Bill File

Via "Import Scanned QR Invoice File", QR Code raw data that is available as a *.txt file can be imported.

Enter Purchase Invoice with ESR Reference

In a purchase invoice go to Process > OPplus to enter the ESR Reference No. or the so called Coding Line.

If you choose the coding line, the program generates the ESR reference number and, if it is an ESR document with a pre-printed amount, the invoice amount. This amount is transferred to the invoice header in the field "Amount code line" and is for your information. The system also checks whether a matching vendor bank account is found for the ESR ID in the coding line (the last 9 characters of the coding line, in this case, "070123459"), and the corresponding vendor is transferred to the invoice header. If no vendor bank account with this ESR ID is found, the program can create the bank account automatically after a corresponding query.

Both the ESR reference number and the coding line can be found on the ESR document that you received from your vendors together with the purchase invoice.

External Document Number

The fields "Invoice No. Start Position" and "Invoice No. Length OPP" have been added to the vendor bank account. If the coding line is filled, the ext. document number is automatically filled based on these parameters.

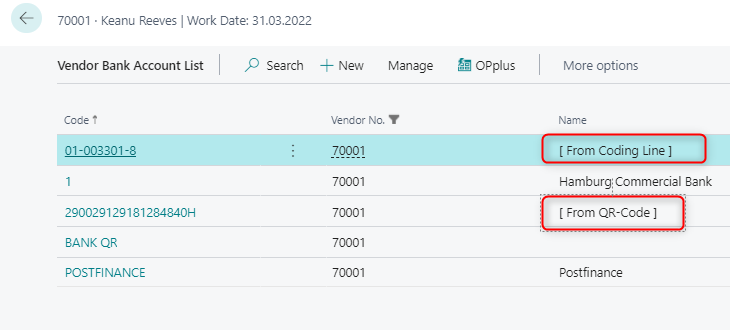

Vendor Bank Accounts when Using QR Code or ISR Procedure

If you scan a QR code or enter a coding line, OPplus offers the possibility to create the vendor bank account automatically if it does not exist. When entering the coding line or the QR code you will get the message that the account for the indicated vendor does not exist. If you confirm the request, the account is created with the corresponding information:

QR-IBAN

For QR references, you must use a QR IBAN with a special IID from 30000 to 31999. In this case, no BIC or BLZ and account number is required.

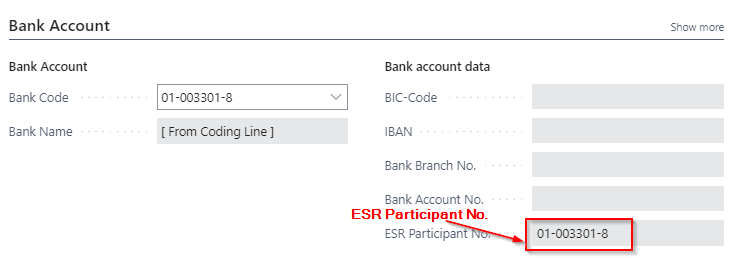

ESR ID

As was already the case when setting up your own bank account numbers, please note that an ESR ID must be set up for the ESR procedure. Likewise, an ESR reference number has to be specified in the open entry. Under these conditions, it is sufficient to specify the ESR ID in the vendor bank account. Bank Branch Code, account number, BIC or IBAN are not necessary.

SWIFT-Code und IBAN

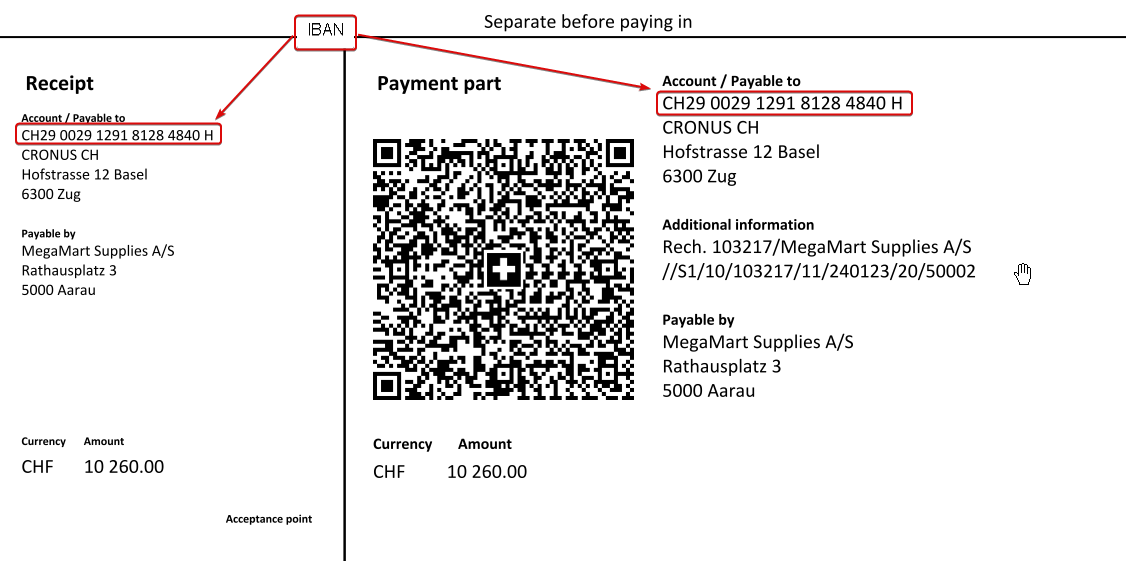

For payments without references, the account must have an IBAN.

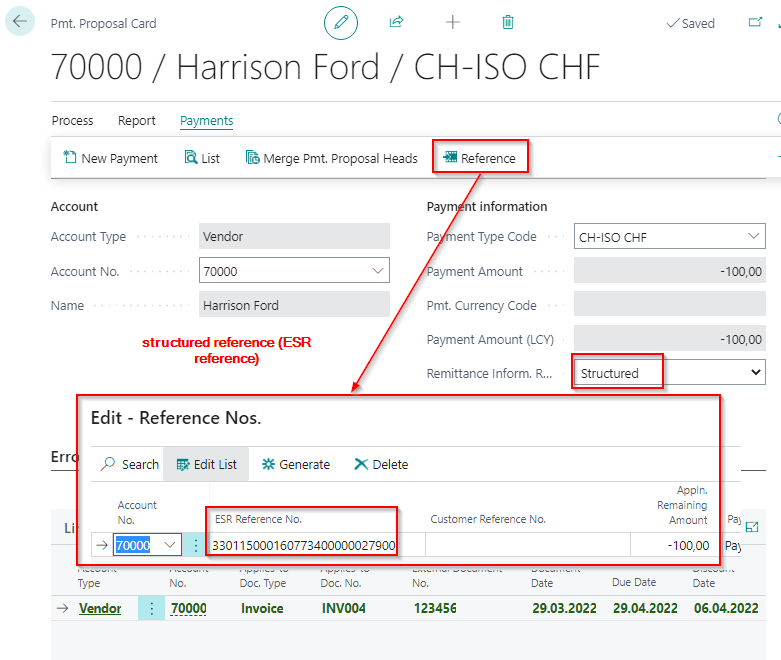

References (Purpose Texts)

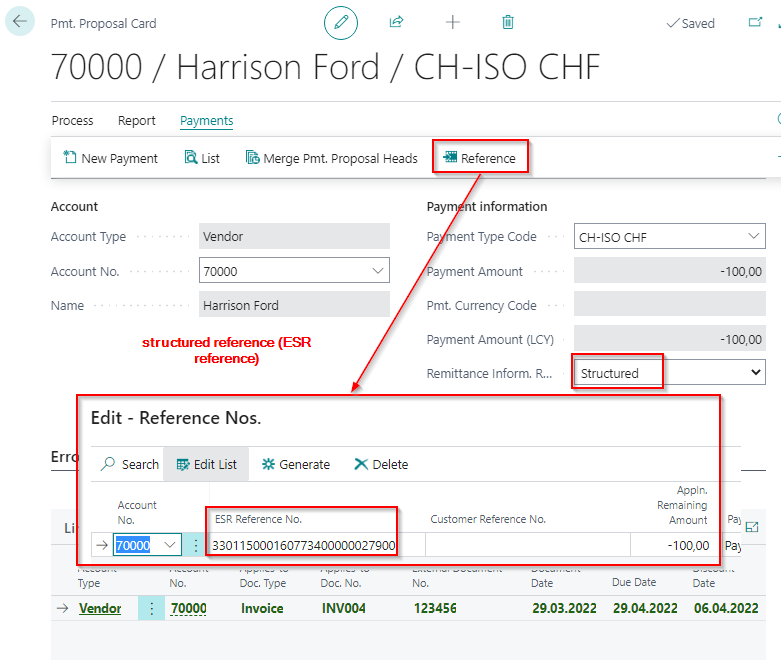

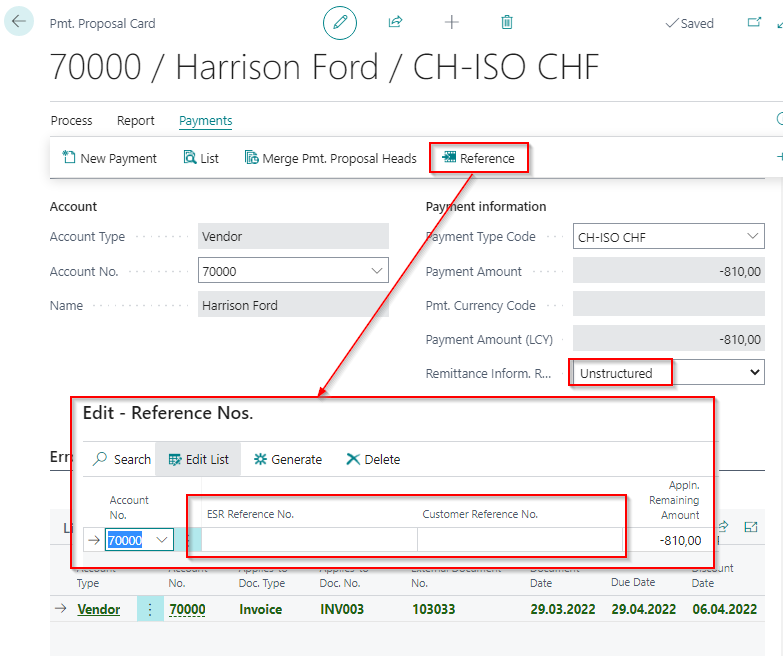

In Switzerland and Liechtenstein, both structured and unstructured references (pupose texts or remittance information) are used. If both vendor open entries with structured and unstructured references are found for a vendor in the payment proposal, a payment header is created for each reference type. If a vendor has open entries with structured and unstructured references for the payment proposal, a payment header is created for each reference type. In the case of payment headers with structured references, one payment line becomes one transaction in the payment file, since only one structured reference per invoice is transmitted to the bank, for example for ESR or QR reference number or ISO 11649 reference.

This stands in contrast to payment headers with possibly several unstructured references (purpose texts), where one transaction per payment header is written to the payment file.

Structured Reference with ESR Reference Number

Structured Reference with QR Reference

Unstructured References

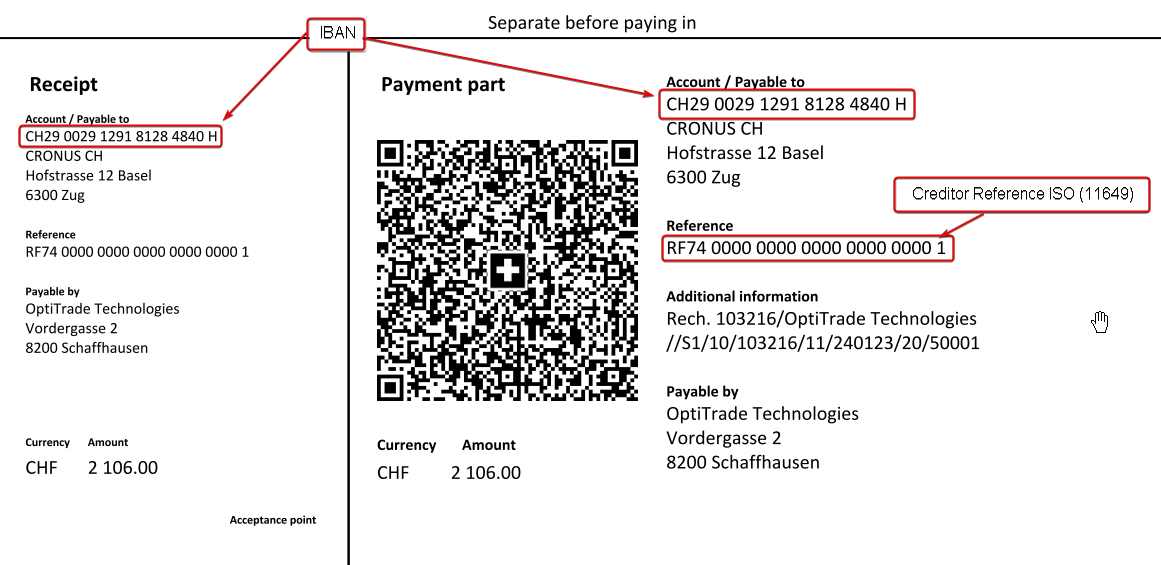

Structured References with "Customer Reference Number"

Entries in the Customer reference number field are also automatically structured references according to ISO 11649 when using the payment transaction CH.

Requirements:

Start with RF.

Maximum of 25 digits long.

Similar to the IBAN, must contain two correct check digits at positions 3 and 4.

Print Sales Invoice with QR Code

Setup

In the Version QR Code Specification field, the current version, currently valid is SPC 0200 1, must be entered. If the field is not filled, this can be done automatically by Create setup data, if the field is still filled with the value BV01 from older OPplus versions, this must be deleted beforehand. In the field QR-IBAN the QR-IBAN is entered, which is used by default for the QR section. If you leave the Standard Reference Type field blank, no QR section will be generated if no QR reference type is specified in the payment form.

In the report selection - Sales, the report 5157944 CH Print QR is to be added for invoice printing.

Print Sales Invoice

The sales invoice is entered in the usual way. After printing the "normal" invoice, another request page opens to start printing the QR section. The created QR reference is stored in the posted invoice (T112), for this the new standard field Payment Reference (ID 180) is used. The created QR code is stored in the OPplus field QR Code (ID 5157943).

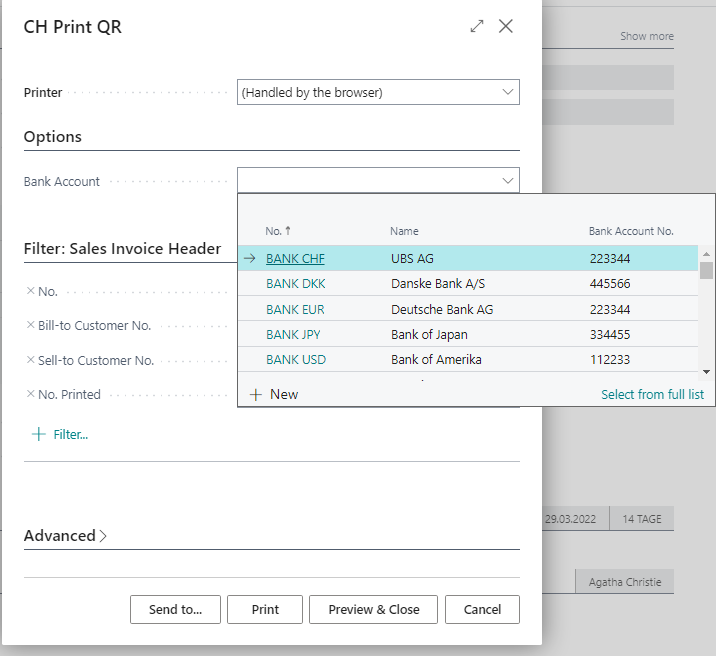

QR Outgoing Invoices from Various Orderer Banks

When printing the QR section, the required data on the beneficiary are stored in the company data (address) and the OPplus Zlg. Export Setup CH (QR-IBAN / IBAN). If there are several orderer banks, it is possible to store the QR-IBAN at the orderer bank and use it for printing.

On the OPplus bank account card, you can enter a different QR-IBAN in the field QR-IBAN. During the input, it will be checked if it is a correct QR-IBAN. In the request page for report 5157944 CH Print QR you have the choice of a bank account, if a bank account is selected, either the IBAN field must be filled or the QR-IBAN field. If you do not select a different ordering bank account, the data from the Zlg. Export facility CH/LI will be used.

Invoice with differing Orderer Bank Account

QR Reference Type

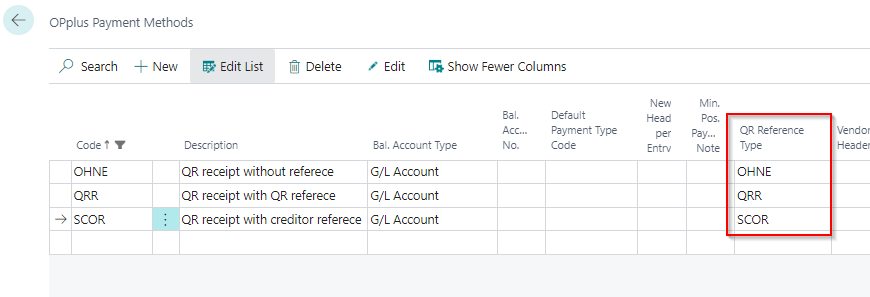

Reference Type Setup

In the Reference Type Setup, you can specify which reference type is encoded in the QR code of the sales invoice. Create an appropriate code here and select the reference and IBAN type for your code.

QR Code with QR Reference

QR Code with Creditor Reference (ISO 11649)

QR code without QR Reference

QR Reference Type in Payment Form

You have the option of defining via the payment method which type of QR section is to be printed. To do this, enter the corresponding QR reference type in the payment method.

For all payment methods in which no QR reference type is specified, the default reference type from the Pmt. Export CH Setup is used.

If you leave the Standard Reference Type field blank in the facility, no QR section will be generated if no QR reference type has been specified in the payment form.

Pmt. Import Setup in Pmt. Export CH Setup

If you import the CAMT bank statements, the reference numbers are reported back in them. If you have activated the Calculate QR reference number setting like ESR reference number in the setup or if you work with the ESR procedure, you still have to make additional settings for the import.

| Field | Description |

|---|---|

| Pmt. Import Interface Code | In this field, enter the code of a pmt. Import interface in this field if you want the relevant Setup to apply only to the selected pmt. import interface. |

| Business Transaction Code | Enter a business transaction code in this field if you want the relevant setup to apply only to the selected business transaction code. |

| Reference Type | Enter a reference type in this field if you want to ensure that the relevant setup is only valid for the selected reference type. Use the same notation here that is used in the CAMT file under |

| Startposition Document No. | Enter the starting position of the document number within the ESR or QR reference number. From this position onwards, the document number is extracted from the reference number and written in a separate purpose text. |

| Length Document no. | Enter the length of the document number within the ISR or QR reference number. |

| Keep Leading Zeros in the Document No. | Check this box if you want to keep leading zeros in the extracted document number. |

| Startposition Account No. | Enter the starting position of the account number within the ESR or QR reference number here. From this position onwards, the account number is extracted from the reference number and written in a purpose text. |

| Length Account No. | Enter the length of the account number within the ESR or QR reference number here. |

| Keep Leading Zeros in the Account No. | Check this box if you want to keep leading zeros in the extracted account number. |