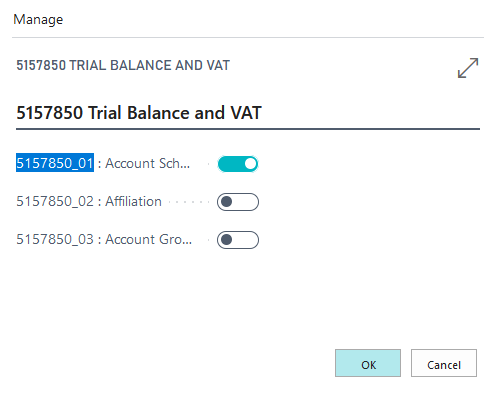

5157850 Trial Balance and VAT

5157850_01 Account Schedule with shifting accounts

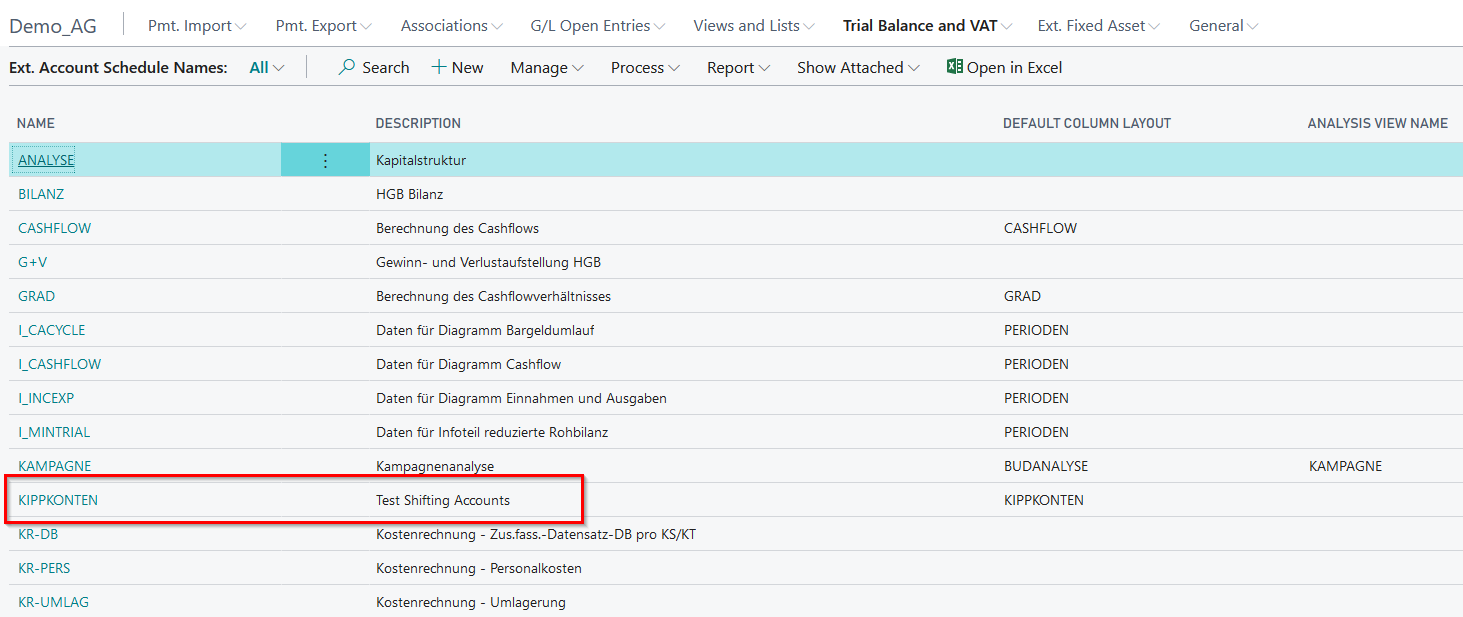

The execution of this functionality through the report 5157991 OPP Build Demodata allows you to present an account schema in which the presentation of shifting accounts has been converted within the framework of a balance sheet generation. A corresponding account schema called "shifting accounts" opens immediately after the report is executed.

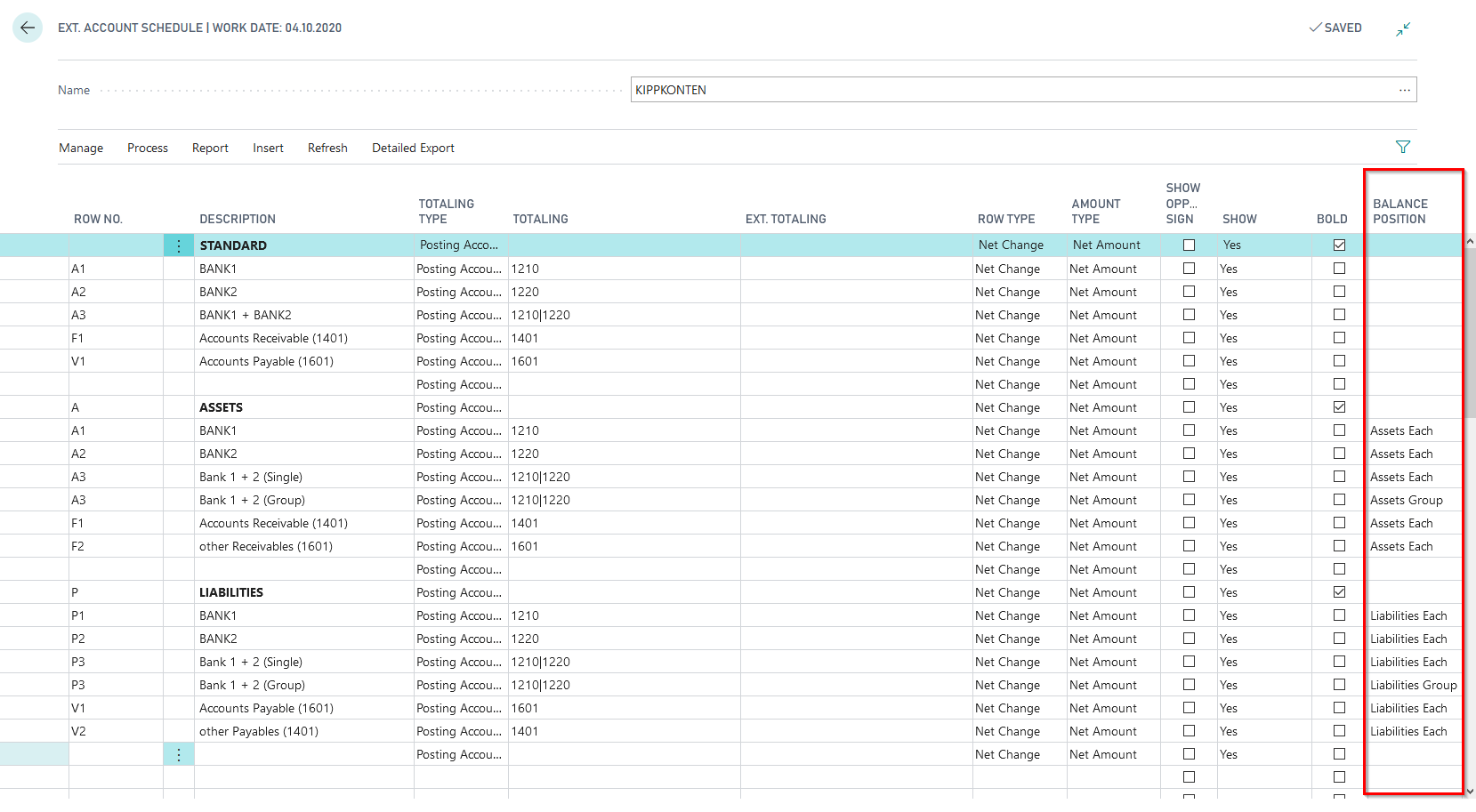

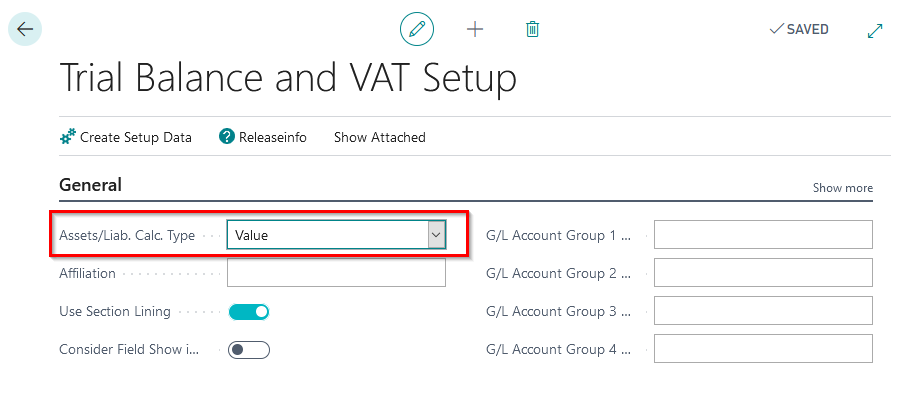

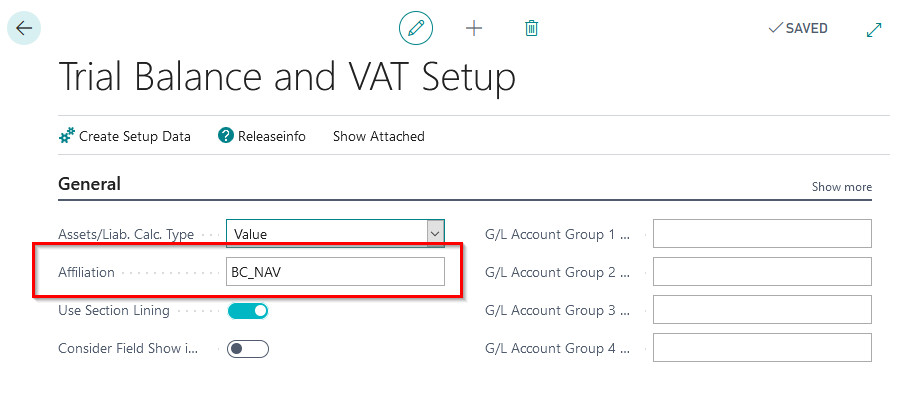

To display the shifting account functionality, the settings in the Balance Sheet columns are relevant here. In order to use this field, an asset/liability calculation type must be defined either in the setup of the "Trial Balance and VAT" module or in the account scheme name. The calculation type set up for the demo purposes is "Value". More detailed explanations of the possible calculation types can be found in the OPplus manual for the "Trial Balance and VAT" module.

If there is no entry in the column Asset/Liability calculation type in the extended account scheme name, the basic setup made in this area will take effect.

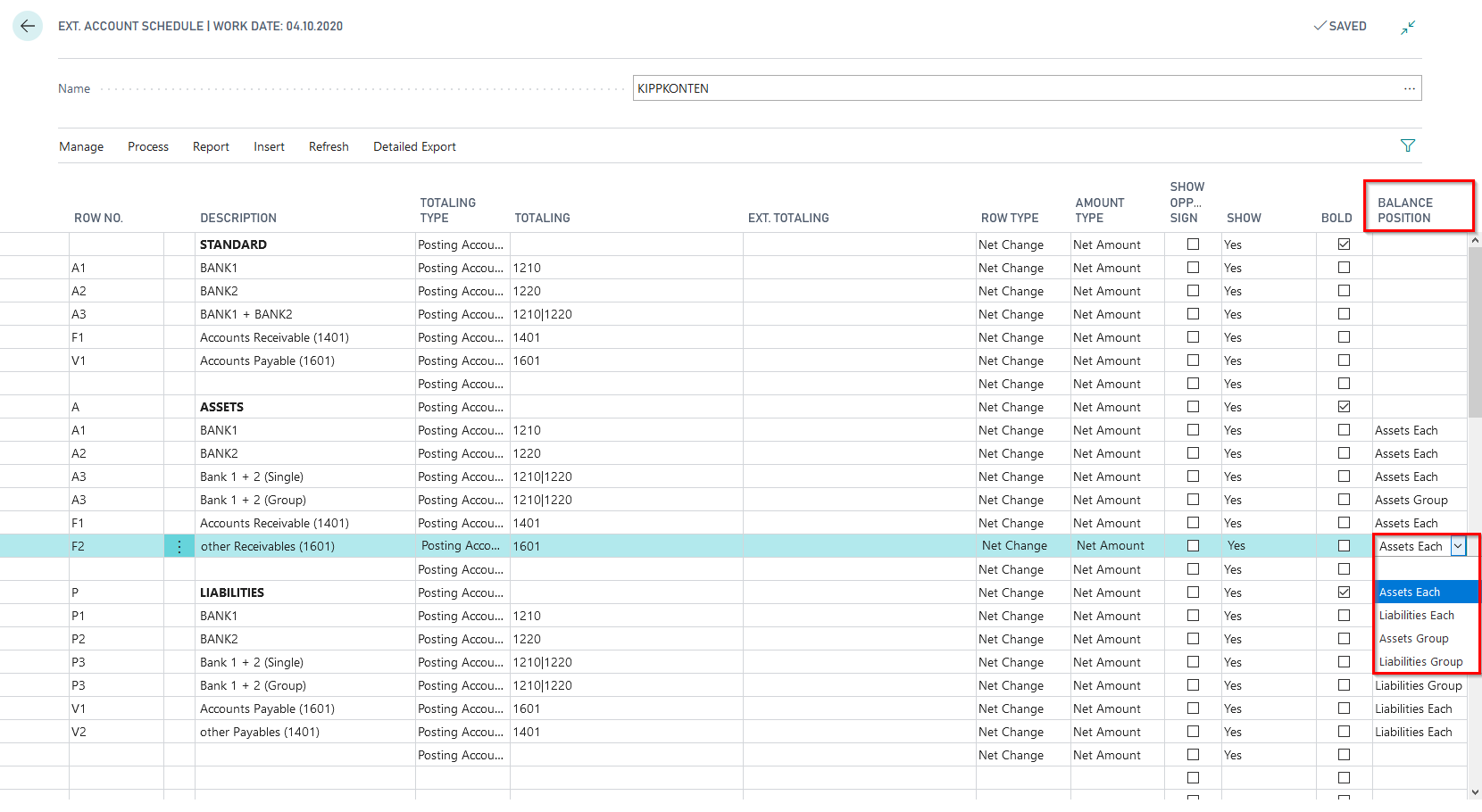

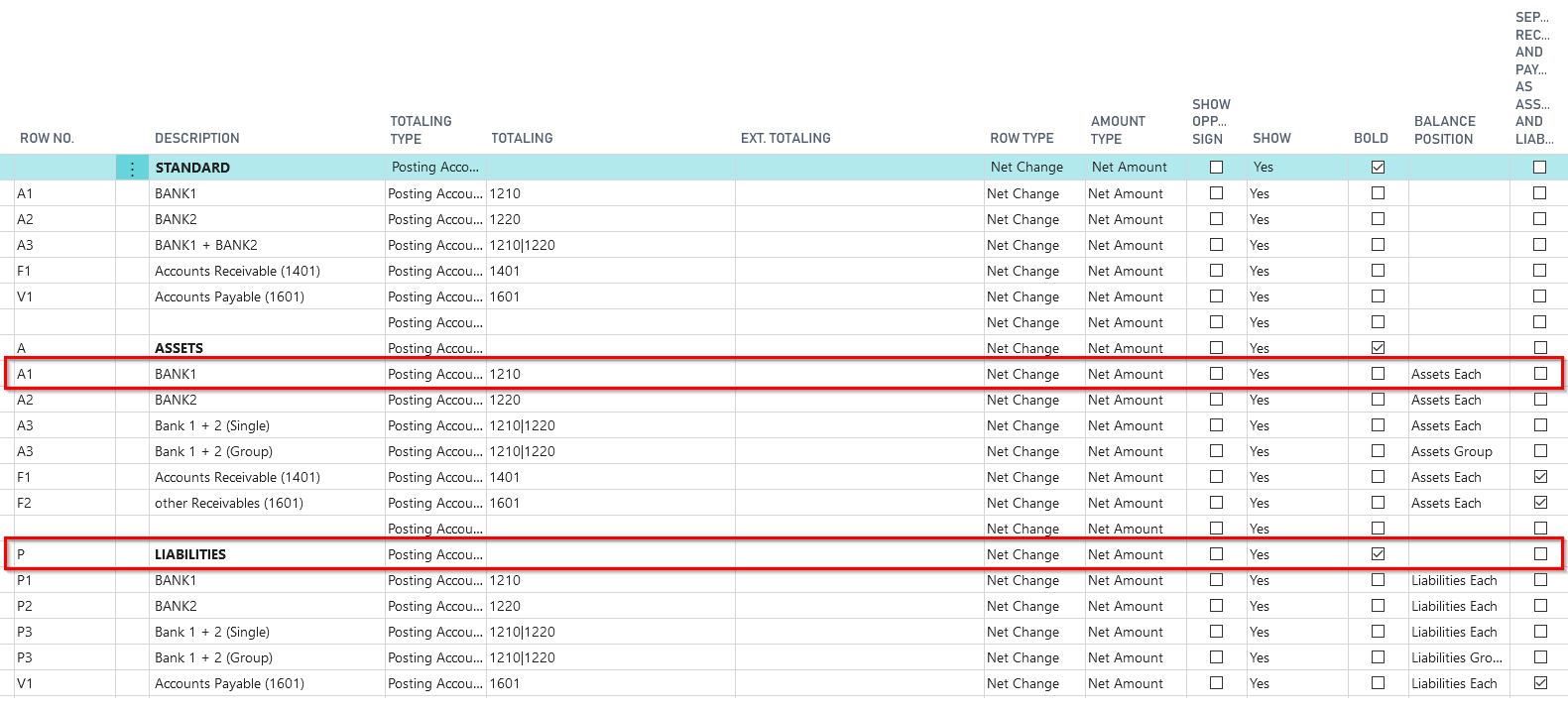

Balance Position

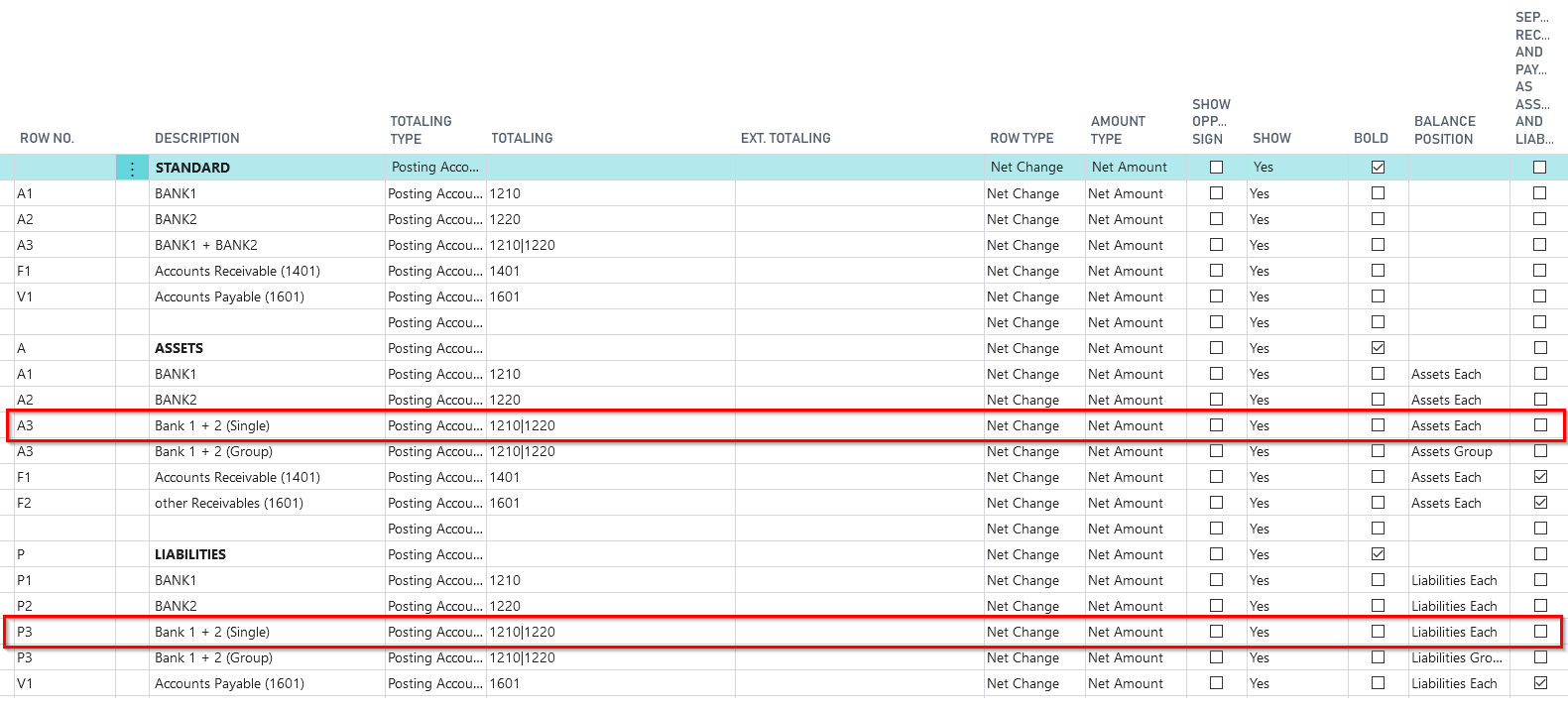

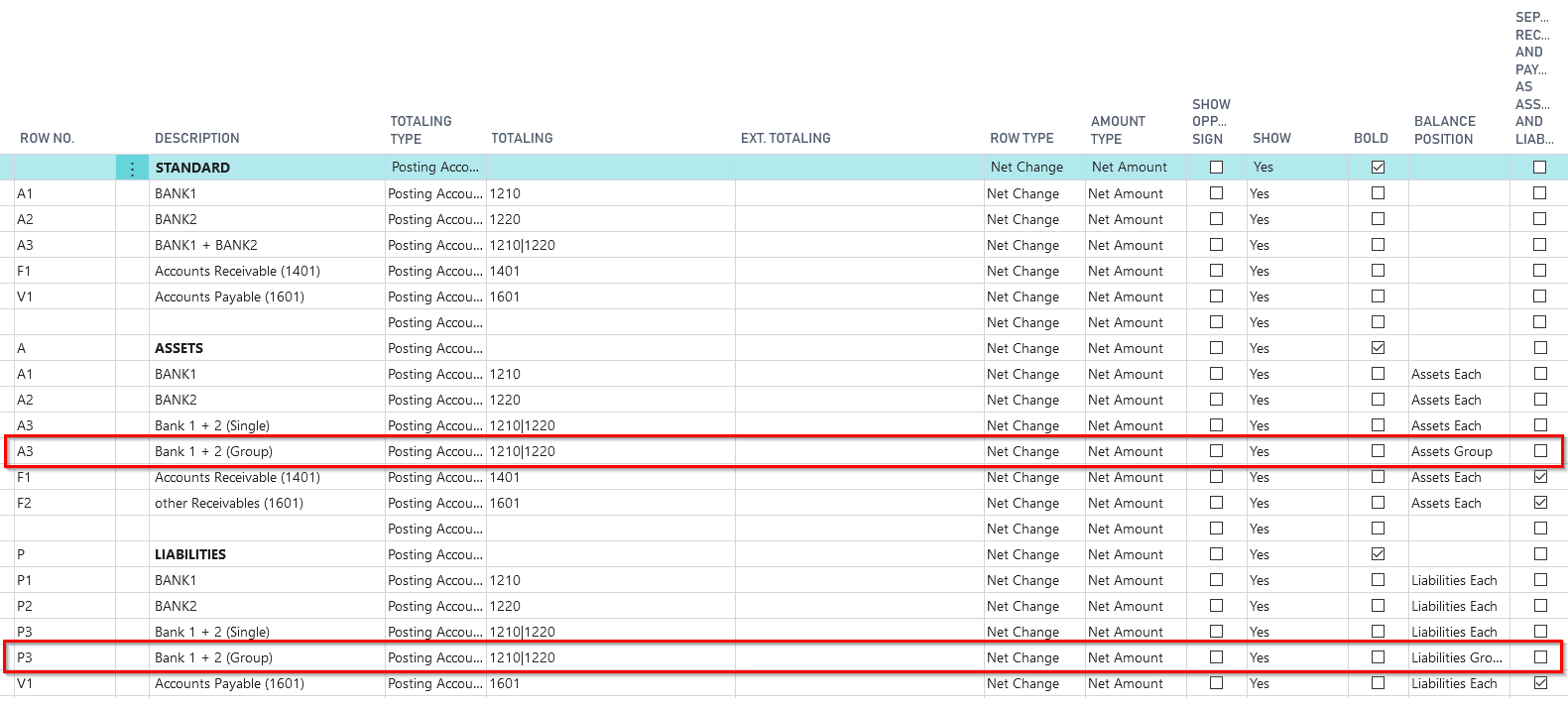

With the help of the entry in the field "Balance Position", you can display shifting accounts and shifting account groups. The calculation is performed for the accounts entered in the "Totaling" field. It is important to note that the "Totaling Type" is "Posting accounts". The following options are available, which you can explain using the existing setup during your presentation and whose effects can be demonstrated on the existing account scheme:

| Value | Impact |

|---|---|

| Empty | Calculated values will always be shown on this line. |

| Assets each | The system calculates the value related to the selected date filter per entered sum in the field "Totaling". That value decides whether it will be shown on the position Assets each or Liabilities each. |

| Liability each | The system calculates the value related to the selected date filter per entered sum in the field "Totaling". That value decides whether it will be shown on the position Assets each or Liabilities each. |

| Assets Group | The system calculates the value related to the selected date filter per entered sum in the field "Totaling". That value decides whether it will be shown on the position Assets Group or Liabilities Group. |

| Liabilities Group | The system calculates the value related to the selected date filter per entered sum in the field "Totaling". That value decides whether it will be shown on the position Assets Group or Liabilities Group. |

Explain here that when setting up the account scheme, for each row with the Balance Position Assets each separately, there must also be another account scheme row with the Balance Position Liabilities each separately, which will request exactly the same values. This ensures that the requested data is evaluated correctly.

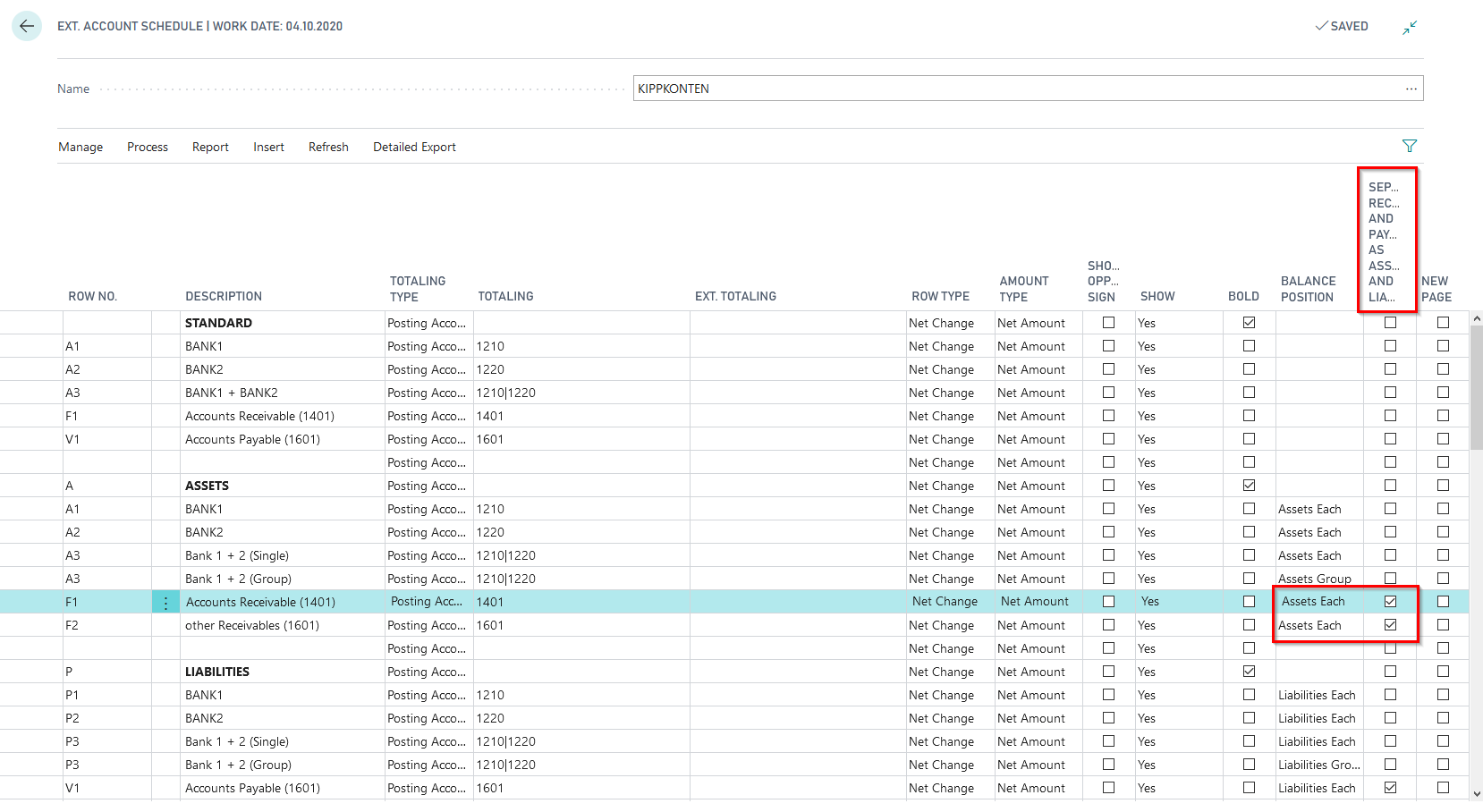

Separate Receivables and Payables as Assets and Liabilities

Here you specify whether the collective accounts are to be separated according to assets and liabilities (for example, for vendors with customer accounts). If you select the Yes option, the balances of the collective accounts themselves are not analyzed, but the customer or vendor accounts behind them are analyzed individually. This field can only be filled if there is an entry in the Balance sheet entry field.

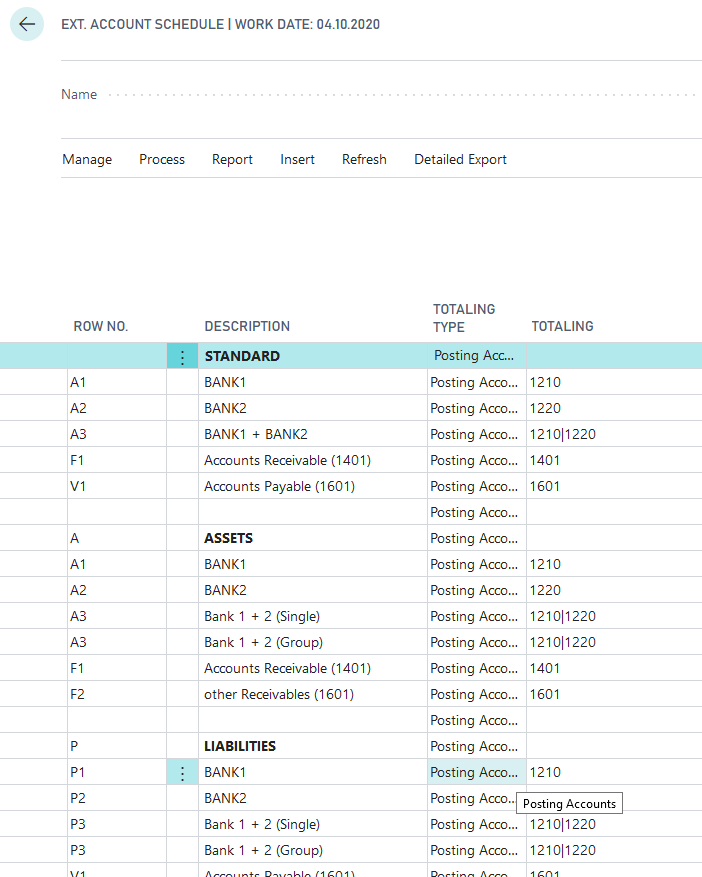

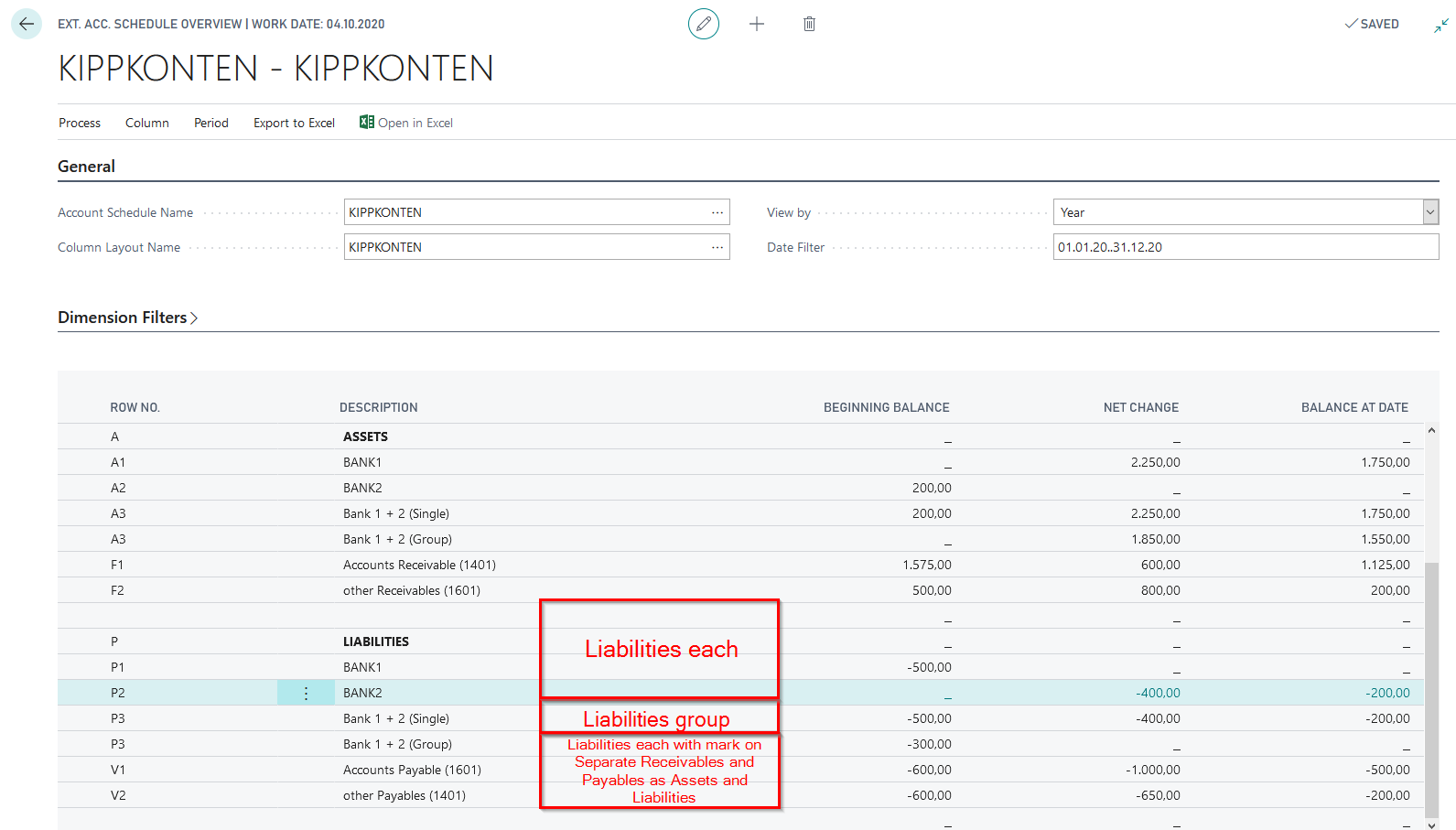

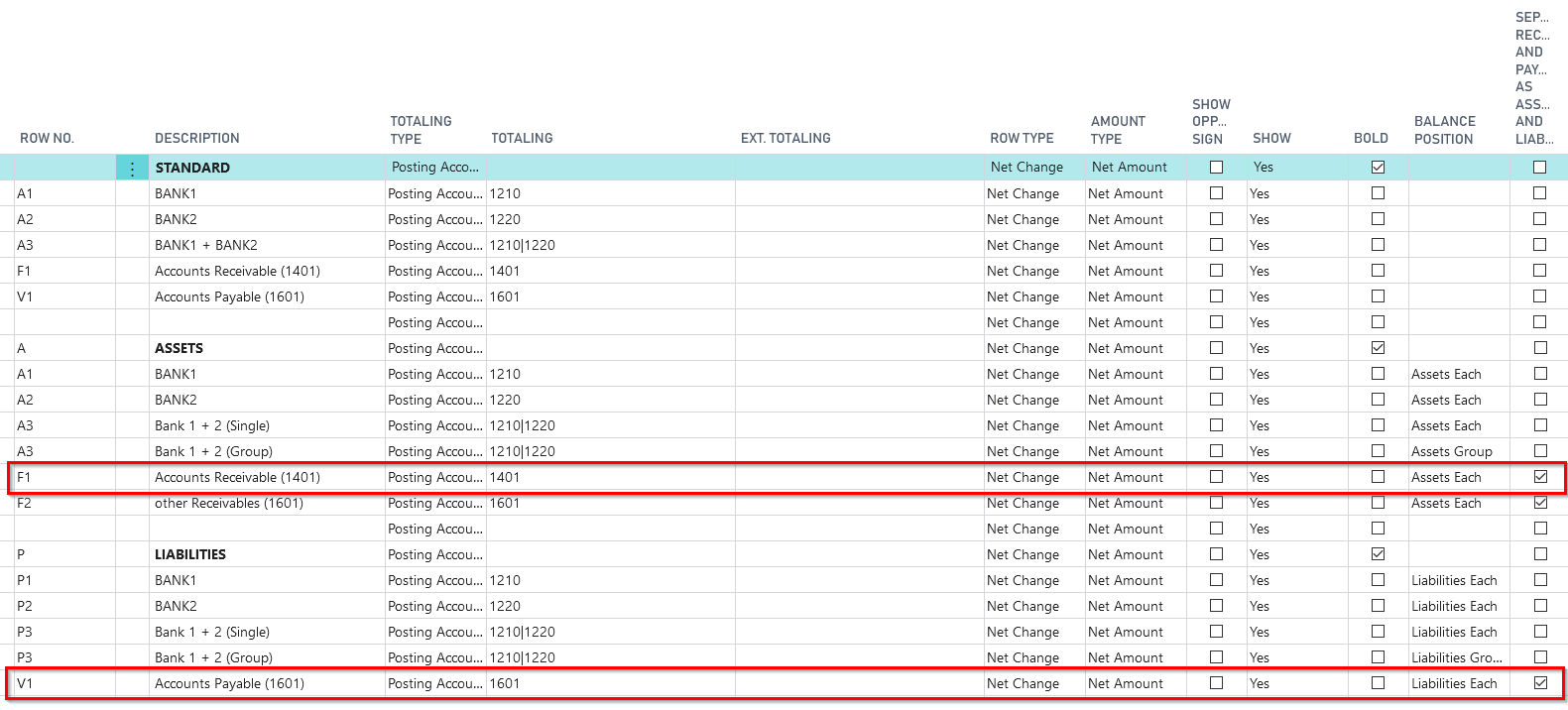

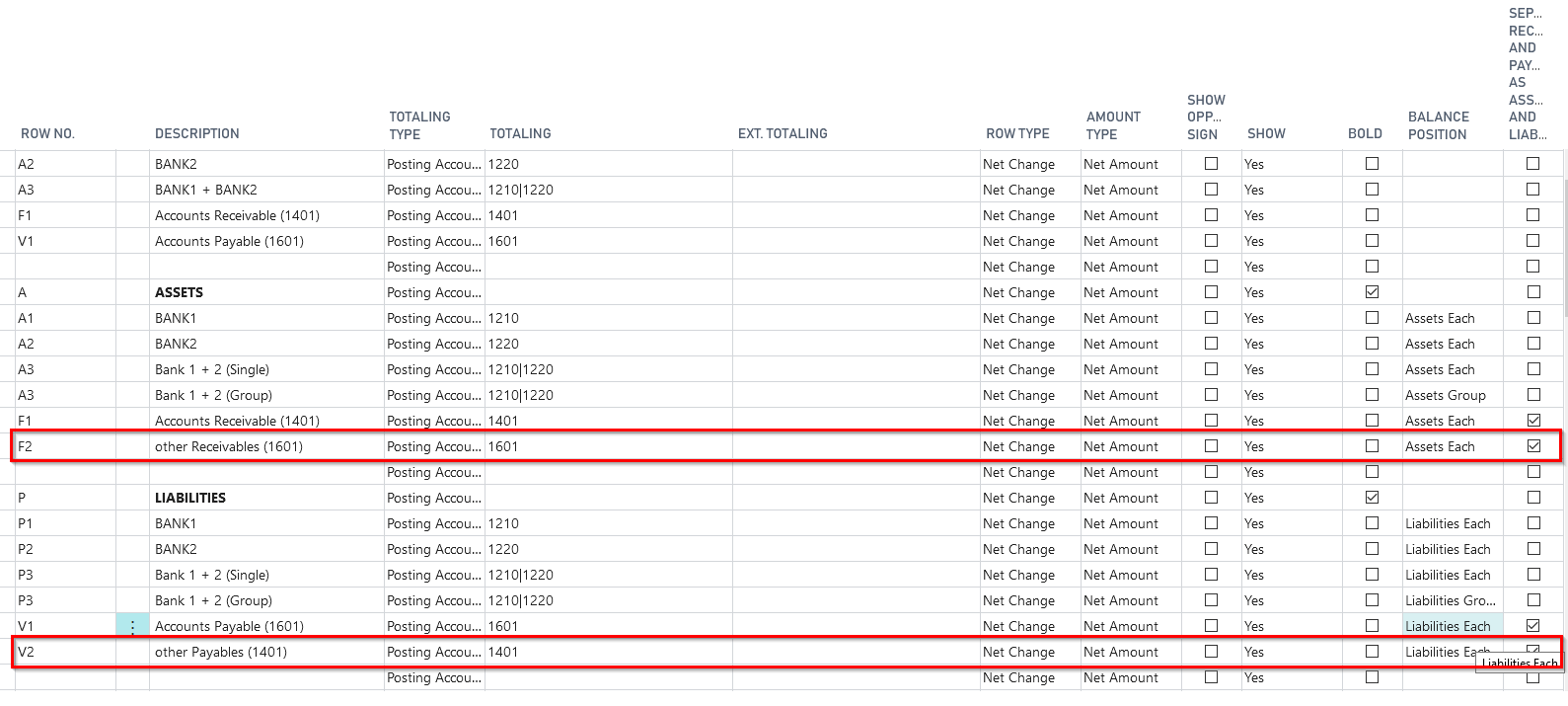

Row numbers of the extended account scheme for demonstration purposes

The created account scheme "shifting accounts- test" for demonstration purposes ist structured as follows:

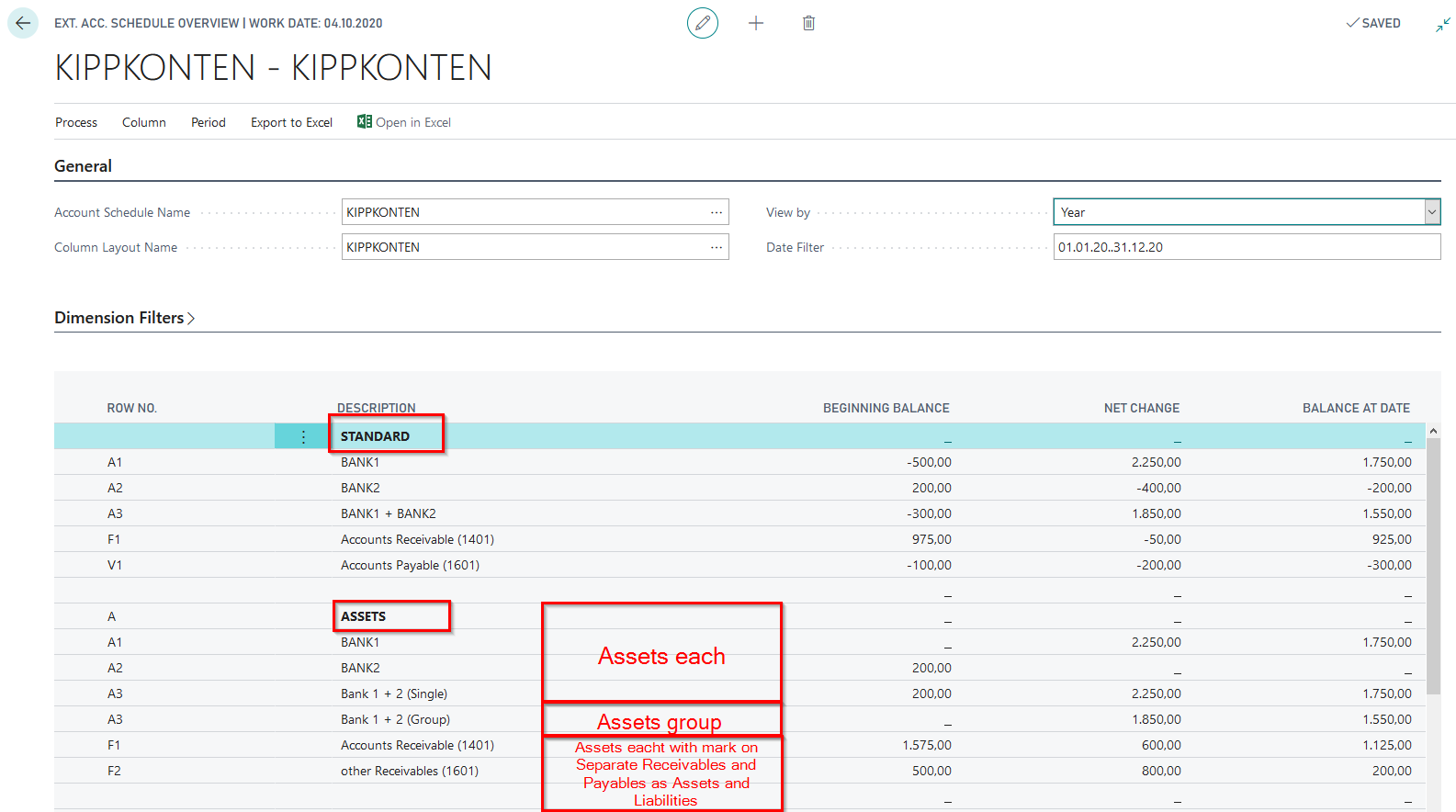

In the row numbers under the description "Standard", the account scheme is set up in such a way that the existing entries of the accounts indicated in the Totaling section can be shown in the matrix as in the BC standard.

In the row numbers under "Assets" and "Liabilities", the setup with the specifications of the extended account scheme is shown in the column "Balance Position". Here you can show the differences in the display of the values for a selected date range in the matrix. Display the differences between standard and shifting account functionality in the matrix or in the corresponding report and show the disclosure of customer vendors and vendor customers based on the analysis of the subledger accounts.

Present the following setup opportunities regarding the function of shifting accounts in the extended account schemes and the results each in the matrix of the account scheme.

Demo setup of a G/L account as a shifting account

Demo setup of multiple G/L accounts as shifting accounts

Demo setup of multiple G/L accounts as shifting accounts (Group)

Demo setup for receivables collective accounts with existing vendor customers

Additionally to the field "Balance Position", you have to set up the column "Separate Receivables and Payables as Assets and Liabilities".

Demo setup for payables collective accounts with existing customer vendors

Additionally to the field "Balance Position", you have to set up the column "Separate Receivables and Payables as Assets and Liabilities".

For more detailed explanations on the topic "extended accounting scheme", please refer to the existing manual for extended analysis or Trial Balance and VAT.

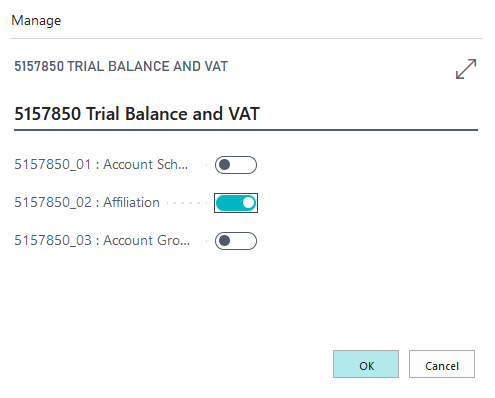

5157850_02 Affiliation

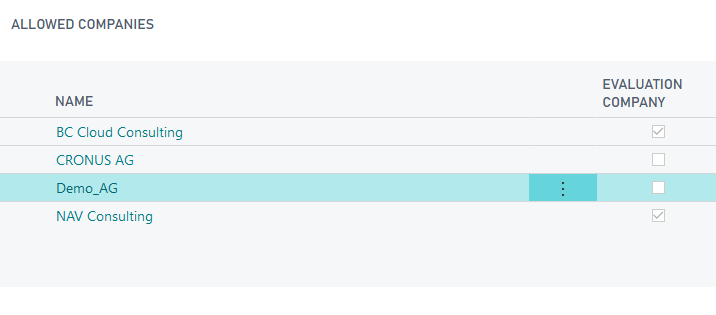

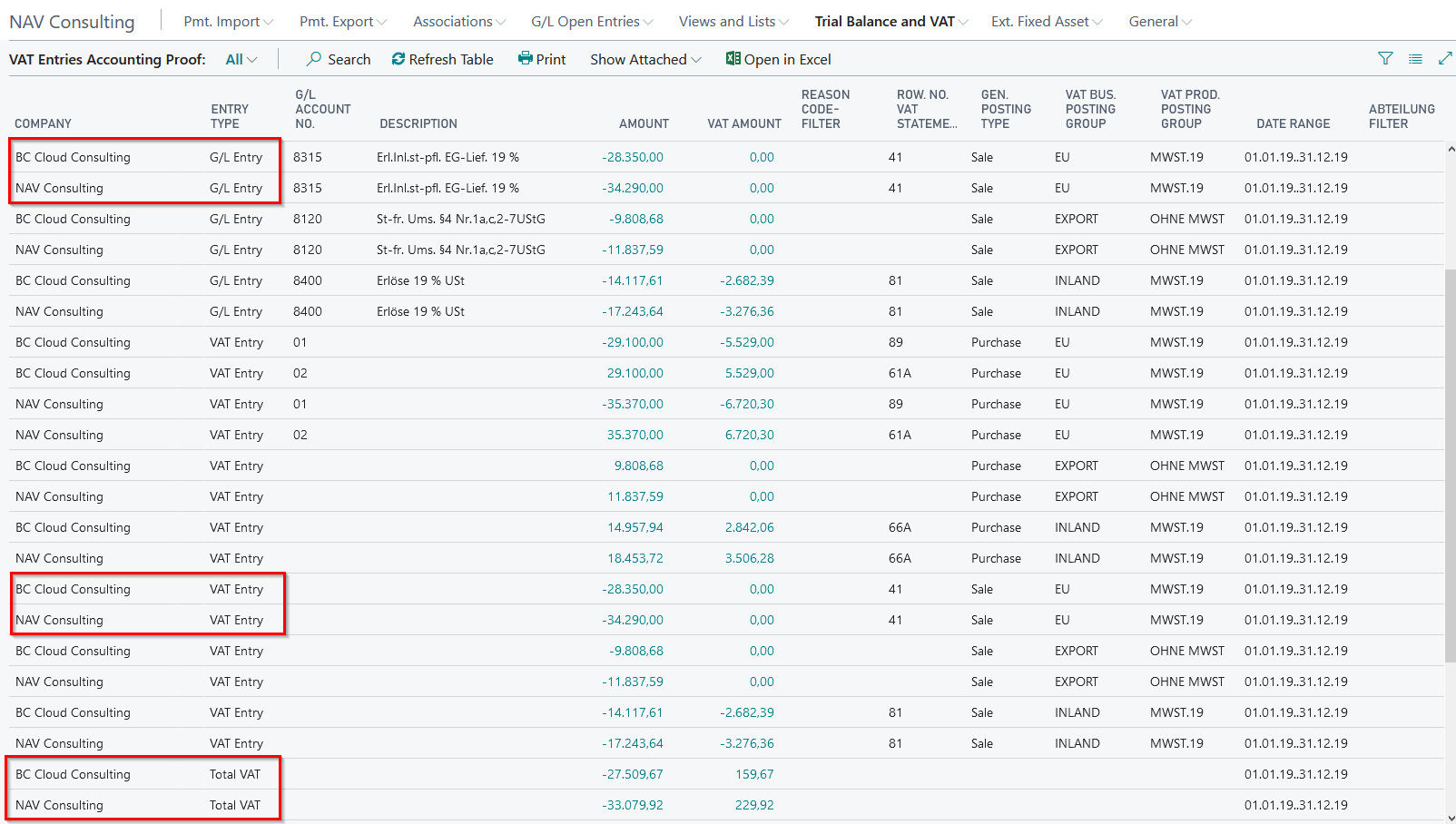

The demo tool creates suitable postings for presentation purposes (Ledger entries and VAT entries) in two different companies and brings them together in a report in an affiliation. The consolidation of the relevant VAT entries can be demostrated in the report "VAT Entries Accounting Proof", but not in the "VAT Statement". The for the demo necessary companies, incl relevant postings, are created automatically and have the names "NAV Consulting" and "BC Consulting".

Show within the created companies, that both companies of the affiliation in the Trial Balance and VAT setup are related to "BC_NAV". This value should be the same for all companies, who are related to the VAT advance return affiliation. Explain, that only those companies, who have the same value entered in the field "affiliation", will be considered in the VAT accounting - here: "BC_NAV".

VAT Entries Accounting proof

The Trial Balance and VAT module also provides the functionality to create a VAT entry accounting proof. The purpose of this is to present the consolidation of VAT entries and tax bases from the individual companies belonging to the "BC_NAV" affiliation. In addition, this report can also be used for any other company that does not belong to a tax group.

The VAT entries accounting proof report transfers, among other things, the G/L account number to which the corresponding tax base of a VAT entry is posted.

Show that for a VAT entry, the heading of the corresponding VAT statement is displayed, in which the entry is included by value. In addition, a line is generated for each company with the total of the VAT entries (entry type = total VAT).

At this point you can show that this value allows you to have a quick look at the calculated value of a payable load/credit per company, related to the displayed VAT entries.

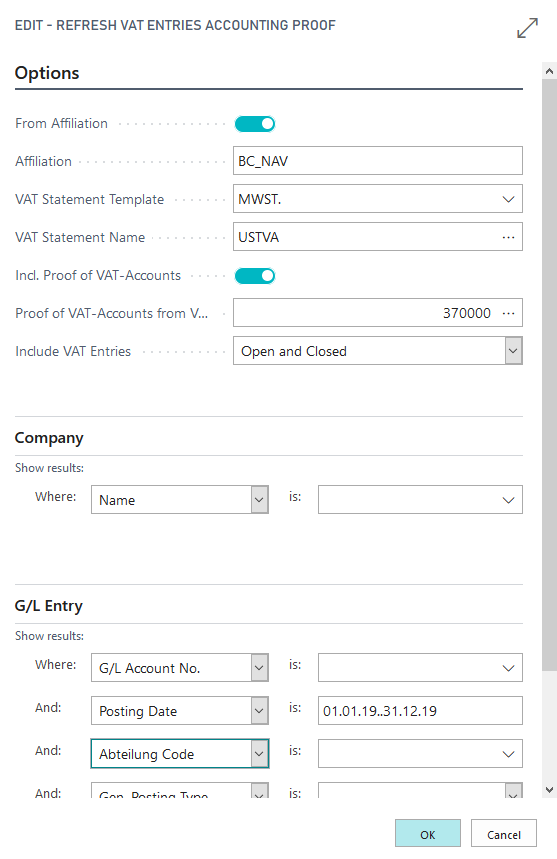

Call up the report via the menu in the OPplus Role Center: Trial Balance and VAT/VAT Entries Accounting Proof. The following menu item "Refresh Table" opens the report options to be selected.

| Register | Field | Explanation |

|---|---|---|

| Option | From Affiliation | This field automatically includes a check mark if you open the Refresh VAT Entries Accounting Proof report for an affiliation company. This way, it is guaranteed that the entries of all affiliation companies are considered in the report. If you want to refresh the report only for the current company, you must deactivate the From Affiliation check box. |

| Option | VAT Statement Template/VAT Statement Name | Here you can specify the VAT statement to be used to transfer the row number when running the Refresh VAT Entries Accounting Proof report. In the VAT Statement Name field, you can select the desired VAT statement. The template name is copied automatically and cannot be modified. |

| Option | Incl. Proof of VAT-Accounts | The VAT accounts will be listed. The prerequisite is that these are set up in the VAT statement. |

| Option | Proof of VAT-Accounts from VAT Statement Line No. | If the VAT G/L account validation is activated, the corresponding line number of the VAT accounting from which the validation is to start is entered here. |

| Option | Include VAT Entries | Possibility to filter the entries according to the setup "open" and "closed". |

| Company | Filter which companies should be considered while refreshing. If no filter is set, only the current company is considered. Please obey the explanation of the above mentioned field "affiliation". | |

| G/L Entry | Filter which G/L entries should be considered. It is possible to set a filter on the posting date, but the report also runs without any datefilters. |

With the function "Refresh Table" the information of the entries are entered. With every refreshing, the previous data will be deleted!

In the context shown here, the VAT Entry Accounting Proof is used to present the consolidation of the necessary G/L and VAT entries of companies assigned to a set up VAT group. In the further course of data processing, these entries are used to create a summarized advance VAT return (UVA) for the so-called controlling body, i.e. for the company who will submit the UVA return to the tax office. The setup of a separate VAT statement "Affiliation" and a corresponding VAT statement name, which is necessary for this purpose, is not part of this demo tool, but is dealt with in detail in the manual for the "Trial Balance and VAT" module and can be individually taken up by you in the presentation if required.

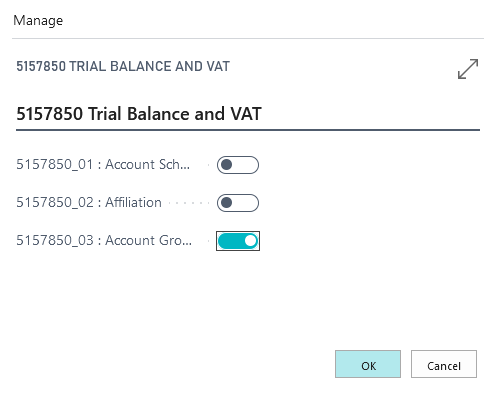

5157850_03 Account Groups

For presentation purposes, the demo tool creates account groups based on the categories and G/L account subcategories defined in the G/L accounts, as well as two corresponding account schemas, where you can demonstrate the functionality of the account groups.

Account groups are build to group G/L accounts into groups that are displayed under one heading in the extended account schemes. To do this, refer to the desired account group in the OPplus column "Extended totalling". For example, G/L accounts could be assigned to certain HGB balance sheet items that were previously defined as an account group. This eliminates the need to store each G/L account in the totalling field of a section of the account scheme.

You can start the presentation by activating the demo mode or without it.

In both cases, the "Balance Sheet Test" and "P&L Test" account schemes created will open first. For presentation purposes, these are structured for all country versions according to the G/L account categories and subcategories available in the BC Standard and therefore do not correspond to the usual HGB (German) classifications.

In the demo mode, it is also possible to display in an accounting sheet and manually enter the transactions that lead to the account group amounts to be shown in the account schemes. Without selecting the demo mode, these entries are automatically made in the background as soon as the presentation is started and the corresponding summarized amounts can be shown directly in the opening account scheme, for example through the matrix.

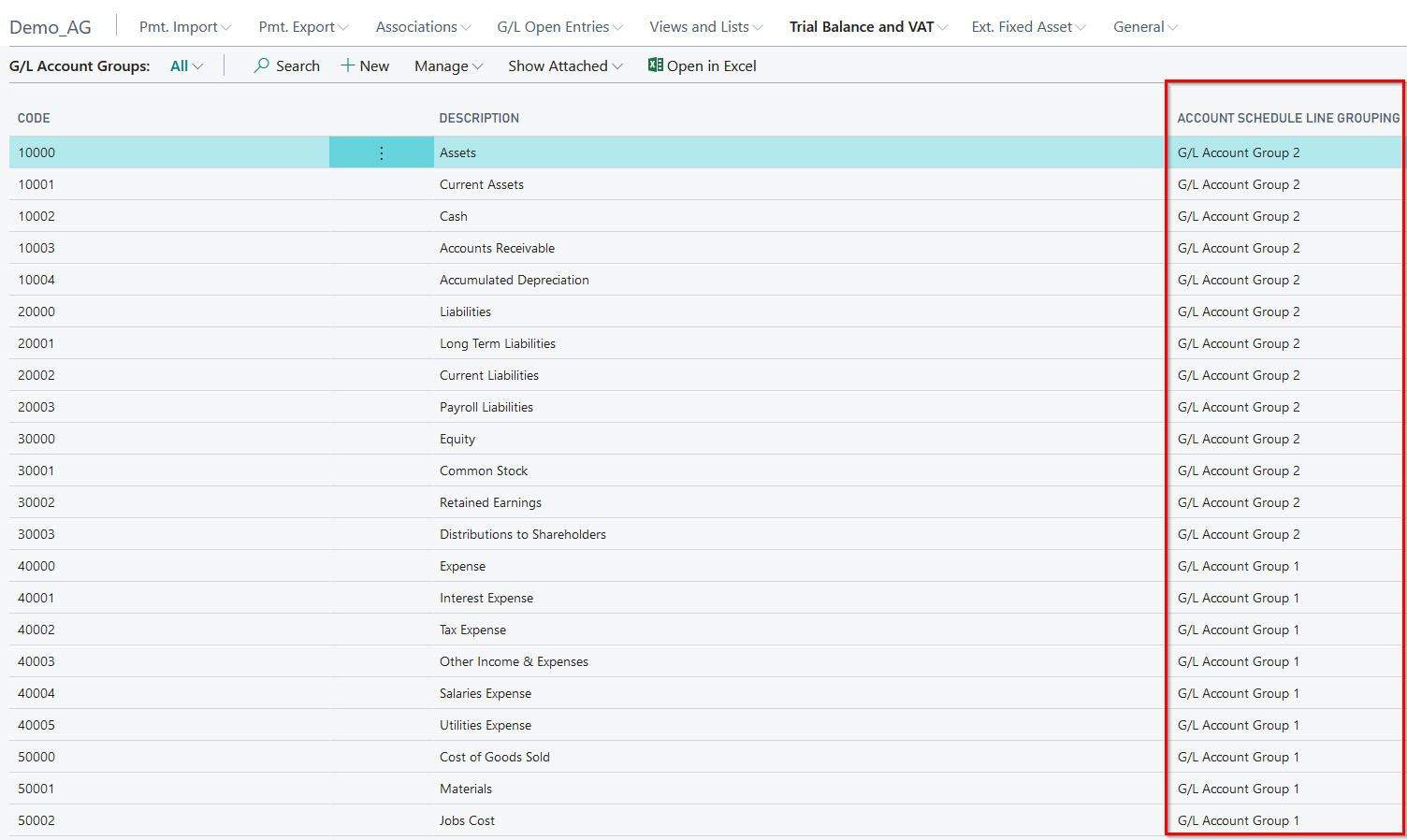

Account Groups

For your presentation, account groups have already been created and assigned to G/L accounts in order to include them in the extended account schemas "Balance TEST" and "P&L Test" in the column "Extended totalling" in combination with the extended totalling type "Account Group". The postings were generated with deviating dimensions in order to present the evaluations with dimension filters.

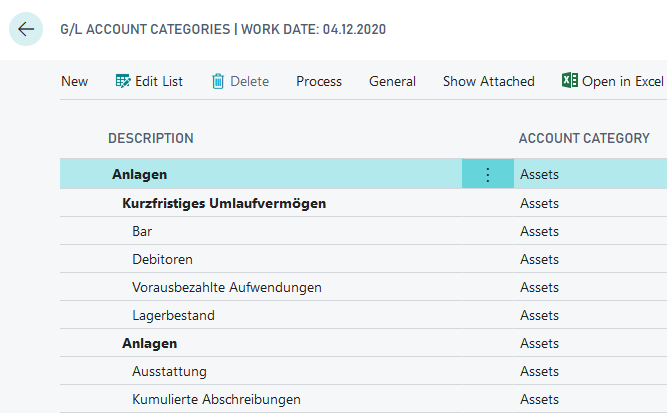

Account groups based on the account categories of the BC Standard:

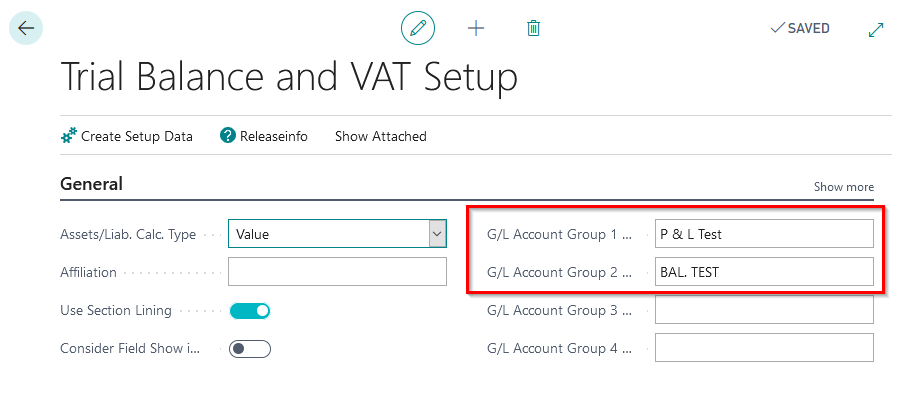

Trial Balance and VAT setup

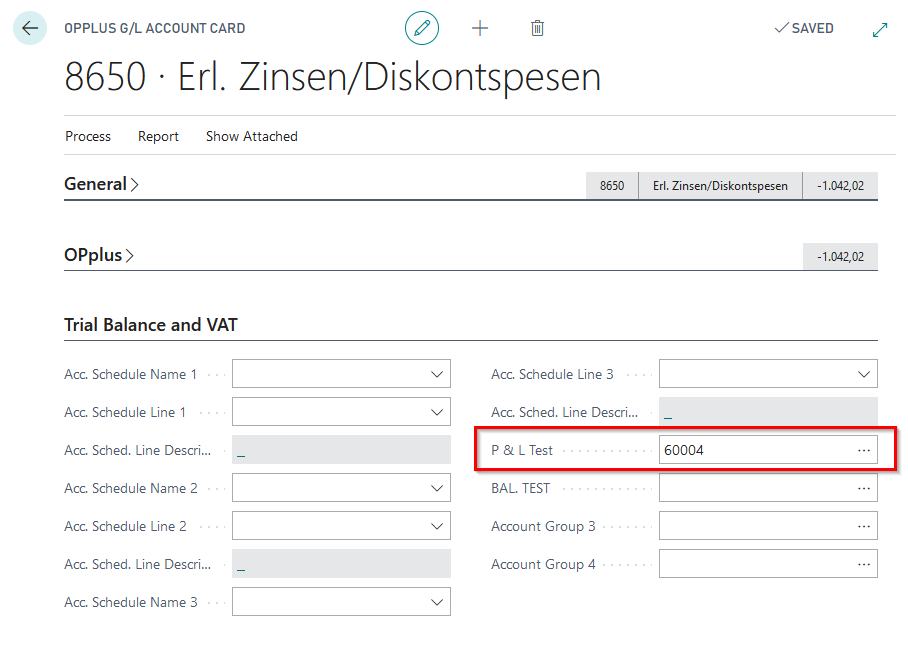

For the presentation of the account group functionality, the fields Account Group 1 Caption and Account Group 2 Caption have already been defined with the terms "P&L Test" and "Balance TEST". These names are used when assigning G/L accounts to each account group, for example in the G/L account card.

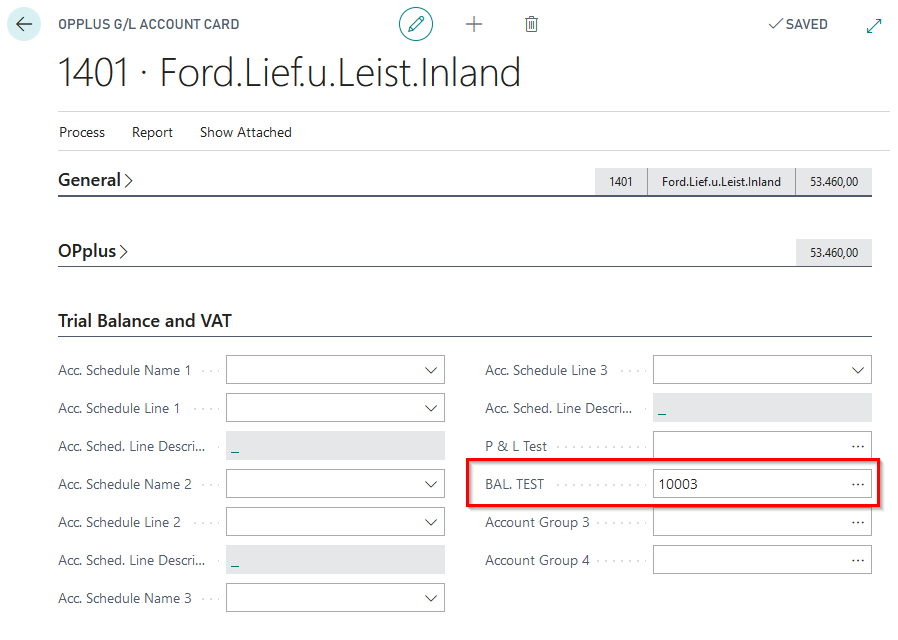

OPPlus G/L account card, Register Trial Balance and VAT:

The G/L accounts assigned to the account groups are queried using the extended account schemes generated by the demo tool, which, as described above, open after starting the presentation 5157850_03.

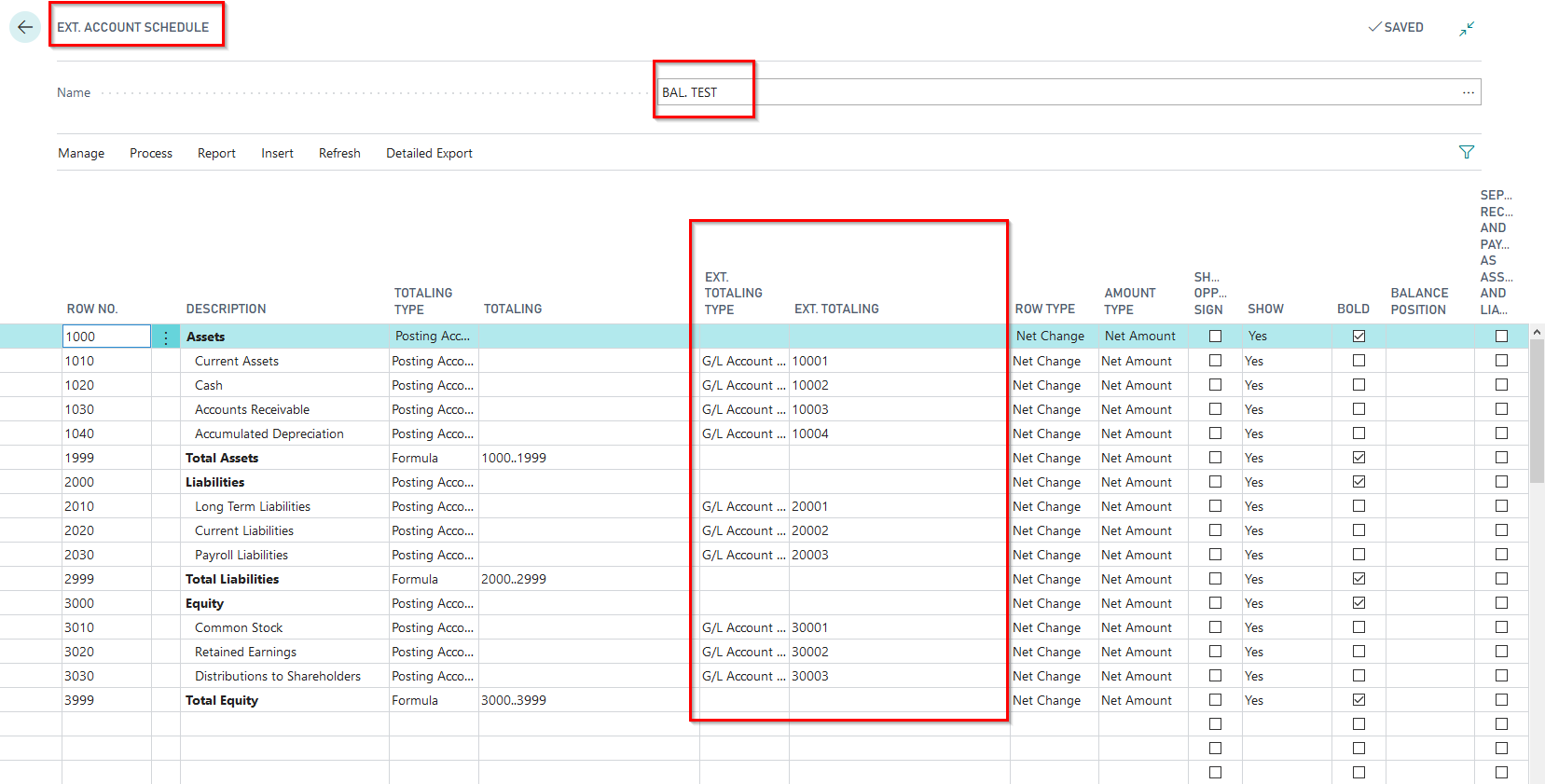

Extended Account scheme Balance TEST:

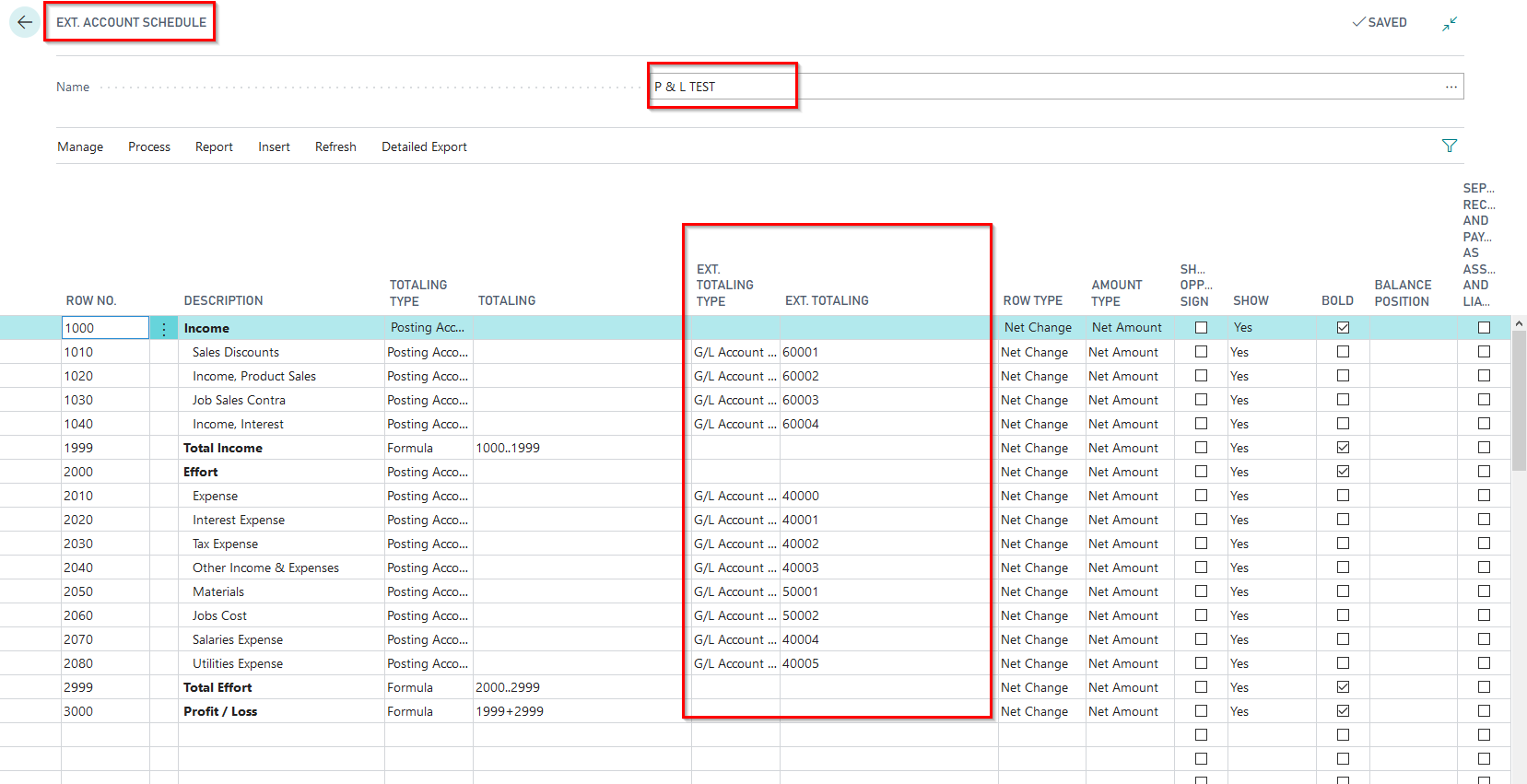

Extended Account scheme P&L TEST:

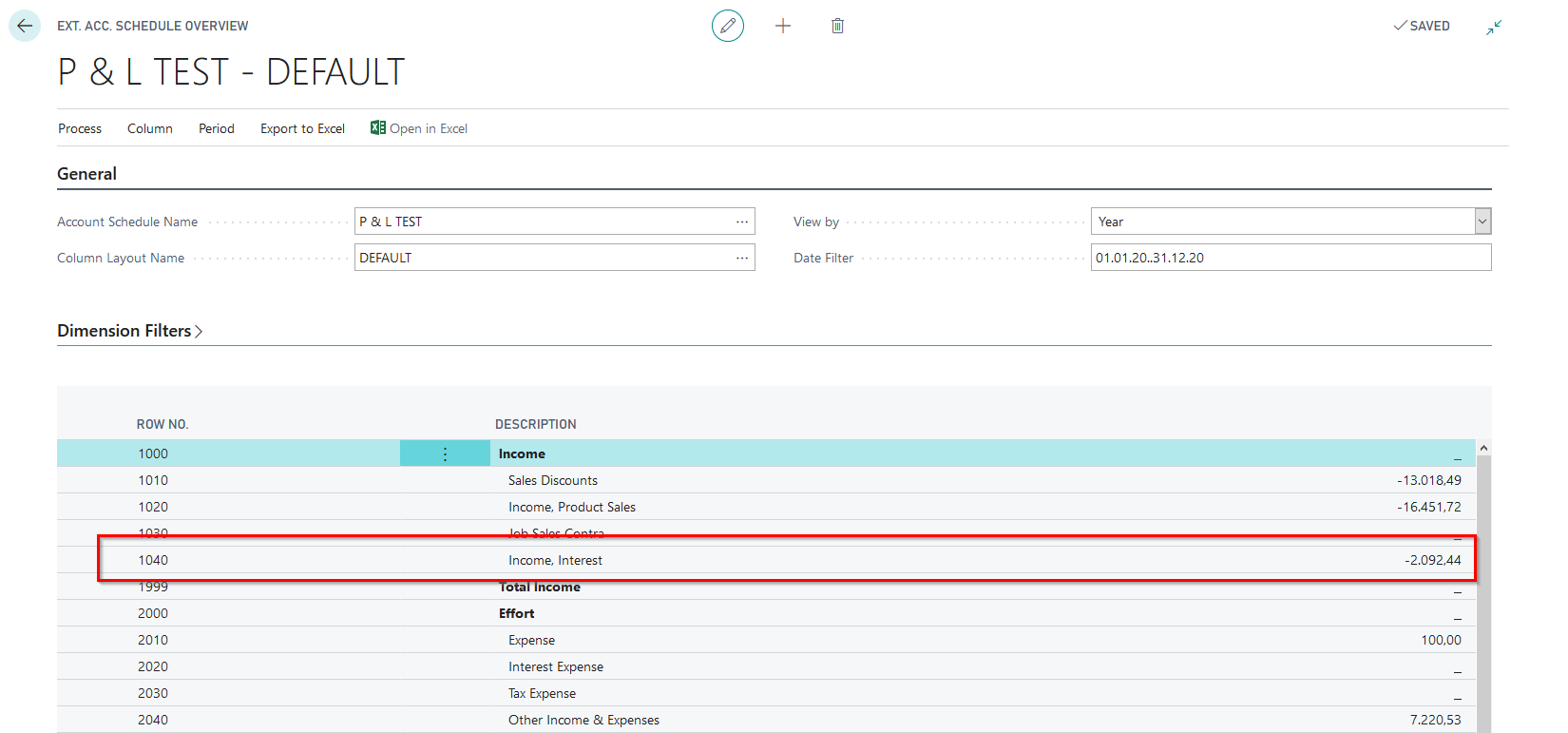

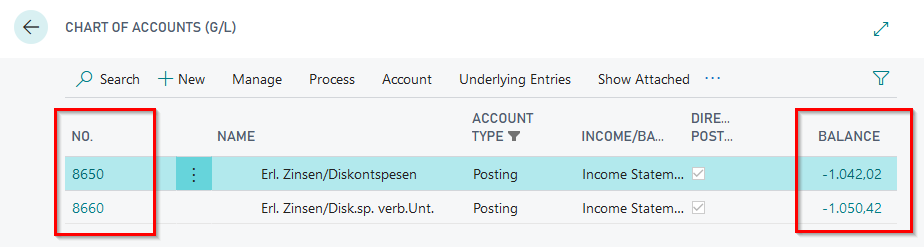

These examples demonstrate the assignment of the account groups to which each G/L account has been assigned to the heading rows of the extended account scheme. By selecting the matrix from the extended chart of accounts, the result of the extended totalling via the account groups becomes visible. The "submerging" via the amounts shown in the matrix to the corresponding accounts and further to an OPplus G/L account card enables you to show once again the connection of the assignment of a G/L account to an account category and the corresponding statement in an extended account scheme with the addition via account groups. In this way you can show, for example, that in the extended "P&L Test" account scheme, the amounts under heading 1040 "Revenue, interest" come from the assignment of account group 60004 "Revenue, interest" to account group 1 and that accounts 8650 and 8660 are assigned to this account group.

For more detailed explanations on the subject of account groups, please refer to the existing manual for extended analysis or Trial Balance and VAT.