Necessary Customer master data

Customer Bank Account list

With the Payment Export module you get the following additional functions for the customer bank account:

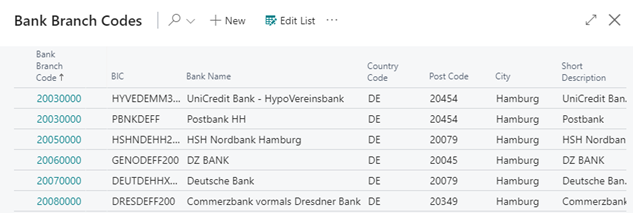

- Assignment of the bank name, bank branch code, and/or SWIFT/BIC from code tables

- Deposit of a payment method code for each bank account

- Entry of a different account holder

- SEPA Direct Debit with Mandate Management

The BLZ and SWIFT/BIC fields of the customer bank account card have the following functions:

- Bank Branch field - If the value you enter in this field exists in the Bank Branch codes table, the following fields of the Customer bank account card will be filled with the values of the Bank Branch codes table:

| Field in Customer Bank Account Card | Field in Bank Branch Code Table |

|---|---|

| Name | Short in Description |

| Post Code | Post Code |

| City | City |

| Country / Region Code | Country code |

| Bank Branch Code | Bank Branch Code |

| SWIFT Code | BIC |

You can also use lookup to branch to the table behind it and select a record.

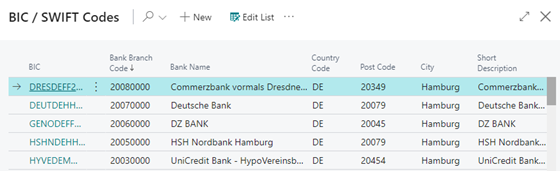

- BIC field - If the value you enter in this field exists in the BIC/SWIFT codes table, the following fields of the Customer bank account card will be filled with the values of the Bank Branch codes table:

| Field in Customer Bank Account Card | Field in BIC/SWIFT Codes Table |

|---|---|

| Name | Short Description |

| Post Code | Post Code |

| City | City |

| Country / Region Code | Country Code |

| SWIFT Code | BIC |

You can also use lookup to branch to the table behind it and select a record.

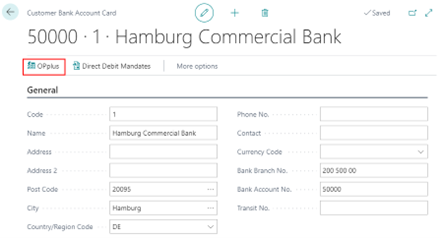

Deposit of OPplus relevant data - The Payment Export module adds the "OPplus" function button to the Customer Bank Accounts card:

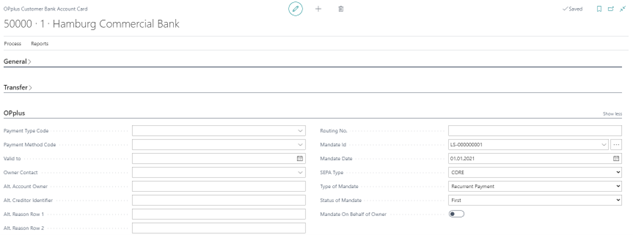

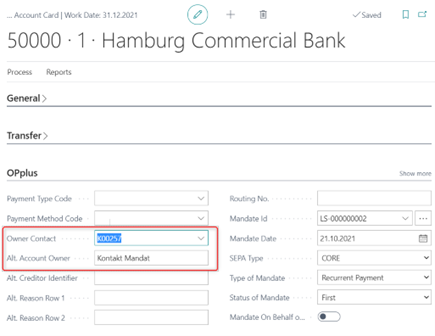

In the mask that opens, you will find additional OPplus fields to the master data:

| Option | Description |

|---|---|

| Payment Type Code | In this field, you can enter values from the Payment Type code table. These bank details will then be assigned to the due items with this payment type when the payment proposal is created. To view the available values, please click on the Lookup button on the right side of the field. |

| Payment Method Code | If you assign a corresponding payment method to the bank account, it is possible to create various payment methods with the same payment type (e.g. SEPA). For each of these payment methods, a separate payment proposal header would then be created in a payment proposal per customer, which in turn would be assigned the corresponding bank account. |

| Valid to | Enter a validity date here until when the bank account may be used for the payment proposal. If the date is exceeded, this bank account will no longer be used in the payment proposal. |

| Alt. Account Owner | If necessary, enter a different account holder here. If the field is empty, the application will use the content of the Customer Card name field as the account holder. Use the Contact table for this purpose. |

| Alt. Reason Row 1 | If a specific purpose is to be used for this account, an alternative purpose can be entered here, which will be used regardless of balanced documents. |

| Alt. Reason Row 1 | If a specific purpose is to be used for this account, an alternative purpose can be entered here, which will be used regardless of balanced documents. |

| Routing No. | For foreign payment types it may be necessary to use the Routing no. instead of the Bank Branch code. In this case it can be entered here. |

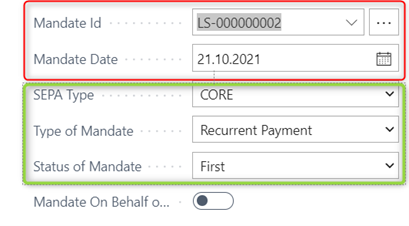

| Mandate iD | In this field, you enter your Mandate ID using the number series SEPA Direct Debit Mandates, which is stored in the payment export setup. The new mandate will be created via the button. |

| Mandate Date | In this field, you enter the date of the mandate. |

| SEPA Type | In this field, you enter which SEPA type should be used. The following options are available: CORE = Business to Customer B2B = Business to Business |

| Type of Mandate | In this field, you enter whether it is a one-time or a recurring SEPA direct debit. The following options are available: One-off Payment, Recurrent Payment. |

| Status of Mandate | In this field, you enter which status the mandate currently has. The following options are available: First time (if it is the first mandate), Recurring (if the mandate is currently used recurrently), Last time (if it is the last valid mandate). |

| Mandate On Behalf of Owner | If a name is entered here, the value of the field "Alt. Account Owner" will be transmitted to the bank when a SEPA file is created. |

SEPA Bank Account Mandates

In the OPplus payment export area, you have the possibility to maintain various bank account mandates per bank account for payments in the SEPA area.

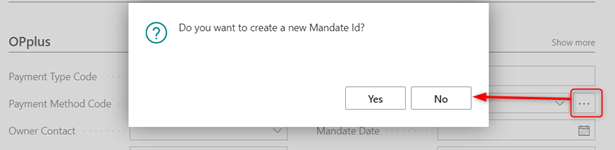

To create a Mandate ID for the first time, you can use the function button on the bank account card for the field "Mandate ID". The system will then ask you if you want to generate a reference:

When you confirm this, the mandate-relevant fields are initially filled in by default (red marking). The other SEPA fields (green marking) must be adjusted manually if necessary.

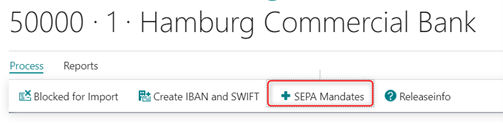

To view the mandates or, if necessary, to store additional mandates, there is a call for "SEPA Mandates" in the header area.

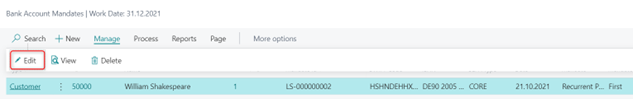

An overview of the existing bank account mandates opens, from which you can also switch to editing.

Here you can change the mandate values according to the specific customer mandate (Validity date-based, Validity amount-based, Validity usage-based, SEPA procedure, Mandate type, etc.).

The generated mandates can then be entered when posting invoices or in the entries.

You can also create multiple mandates for a bank account. This is necessary, for example, if a mandate has expired (valid until date exceeded) and a new mandate is issued. The old mandate should then continue to exist for information purposes but should no longer be used.

You can then remove the "Mandate ID" field from the account. In the background, the bank account references are now removed from the mandate. A new mandate can now be created via the AssistEdit, which is valid again.

This gives you the possibility to manage your mandates per account and to exchange them if necessary.

Important to realize:

- a mandate can only be directly assigned to one account

- a mandate can only be selected if the Mandate ID field is empty

- removing the "Mandate ID" value does not delete the mandate, but only removes the references to the account.

SEPA mandate history

If a mandate is used during payment file creation, the system automatically checks in the background whether a data record already exists in the mandate history for this mandate.

If this is not the case, the use of this mandate is logged with the current settings. If a data record does exist, it is checked for deviations:

- Is the name identical

- Are the account number and the bank branch code identical

- Are the IBAN and SWIFT identical

- Are the mandate settings identical

If a discrepancy is detected, a new record is entered into the history with the new information and new revision number.

You can view the history in the bank account mandates:

Contacts in SEPA mandates

It is possible to select a deductible account holder via a contact. This is done on the customer or vendor bank account card.

If a value is entered in this field, the address stored in the contact will be taken into account in the mandate print and in the reassignment print.

SEPA 3.1

By default, the latest version SEPA 3.1 is integrated in OPplus Payment Export. The special features of this version are described here.

Pmt. Schemas Orderer Bank (BIC required)

If the bank is located in a country outside the European Economic Area, it is mandatory that the BIC code is also transmitted in the file. The IBAN Only regulation is then no longer given.

In the OPplus payment export it is always the case that the BIC code is written into the file if it is available. However, no error message is automatically generated if this is missing, since the IBAN only checks have been integrated accordingly.

In order to map this SEPA version, a corresponding setup must be carried out in the payment schema for the orderer bank. The field "BIC mandatory" is integrated here.

The following options are available:

- blank - The standard checks apply. The standard checks for SEPA 3.10 are: first, the application checks the IBAN of the originator and the recipient. If there is a discrepancy in the country here (analysis of the first two characters), the next check takes place. The application then checks whether a scheme for the orderer bank has been found at all. If this is the case, the corresponding SEPA version fields are checked.

- yes - A BIC code must be specified; otherwise, an error message will be generated

- no - No BIC code needs to be specified; no error message will be generated.

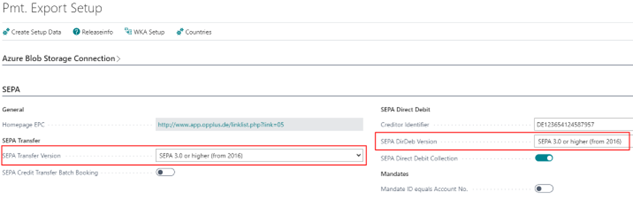

If no scheme was found, then the system checks the settings of the payment setup:

Note

If the SEPA version "SEPA 3.0 (2016)" has been set up here, a warning message will be generated if the BIC code is missing. If SEPA version 3.0 is not used here either, no note will be generated.

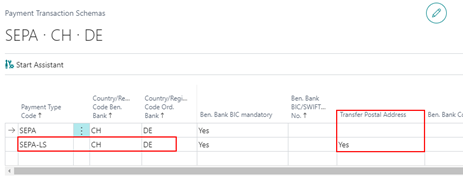

Payment Transaction Schemas (BIC + address required)

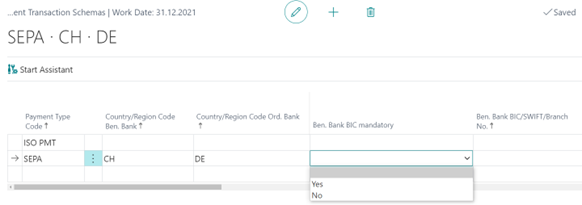

As with the orderer bank, the receiving bank must also include a BIC code if it is located outside the European Economic Area. The behavior of the checks is similar to that of the orderer bank. However, the setup takes place in the Payment Transactions Schemas table. Here the field "Ben. Bank BIC mandatory" is evaluated.

Should a corresponding test take place, the setup as shown below is useful:

The field "Ben. Bank BIC / SWIFT / Branch No." is to be left empty and the BIC check is to be activated with "Yes".

This setup means that a SEPA file from DE to CH with empty BIC code will generate an error.

For SEPA direct debits, in addition to the BIC code, the address must also be checked if the bank of the payer is located outside the European Economic Area. A setup is accordingly possible in OPplus in the payment transactions schemas.

The "Transfer Postal Address" field is set to "Yes" for this purpose.

If the complete address is not maintained for the customer, the user will receive an error in the payment proposal header: "Complete address of recipient required"

The following fields are mandatory:

- Name

- Address

- City

- Country/Region Code

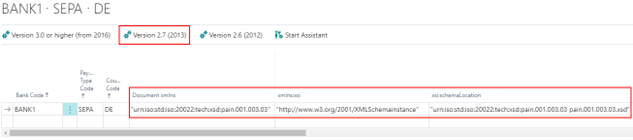

SEPA 2.7

In OPplus the SEPA format 2.7 is also supported. If this format is required by the bank, this can be done via corresponding settings (payment schemas). In the schemas, the user has now also the possibility to create different defaults. Here the two most frequent SEPA versions are given: Version 3.0, Version 2.7, and Version 2.6.

The corresponding "pain" details are filled accordingly depending on the default and can be changed for other versions if necessary, if a bank does not support the latest 2 formats.

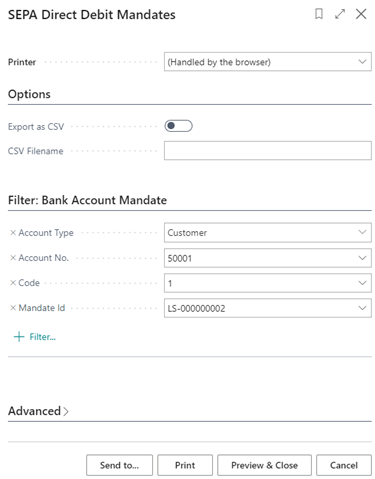

SEPA direct debit mandates

To print or send the mandate:

From the mandate view, select Reports > Print Mandate/Send Mandate

This report can also be called from the customer or vendor bank account. To send the mandate by e-mail, a reminder method code must be set up in the Pmt. Export setup for the mandate e-mail.

You have the possibility to enter comments for individual mandates. These will then be displayed accordingly in the FactBoxes. Printing of these comments is not integrated.

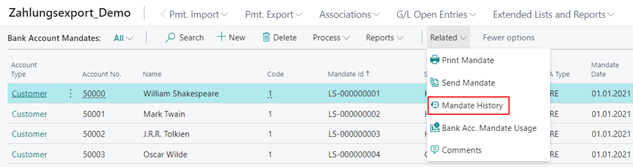

Mandate History

If a mandate is used during payment file creation, the system automatically checks in the background whether a data record already exists in the mandate history for this mandate. If this is not the case, the use of this mandate is logged with the current settings. If a data set exists, it is checked for discrepancies:

- Is the name identical

- If the account number and the bank code are identical

- Are IBAN and SWIFT identical

- Are the mandate settings identical

If a discrepancy is detected, a new data record with the new information and new verification number is entered in the history.

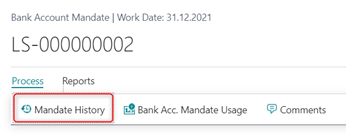

To view the mandate history:

- On Bank Account Mandates, select Related > Mandate History.

Tip

In addition to the mandate history, which only logs corresponding changes, a mandate usage is also written. This contains a separate record for each use. This record is written as soon as the payment is processed.