Importing MT940 and CAMT files using the two-step import method

For the import of MT940 and CAMT files, a two-step import routine has been introduced. This type of import enables to perform bank posting in a quick manner. The actual bank values are immediately available to the users (e. g. from a treasury department). The applications are posted in a second step.

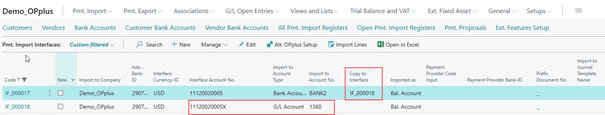

In order to use the two-step import, it is required to work with 2 pmt. import interfaces. The first interface is automatically created during the first import of a file (if not already available).

If you want to use the two-step import, you have to re-create this interface manually and to name it in meaningful manner (e. g. by using an X after the interface account no.). Enter the name of the second interface “Copy in Interface“ field of the first interface.

The first interface uses a G/L account via BC code accounting rules. In the interface itself, the bank is specified as account.

The corresponding G/L account is specified for the second interface which has been specified in the BC codes of the first interface.

In order to maintain the GV Codes, you must run the import once until it is imported into the ext. cash receipt journal, so that the respective GV Codes are created. In the BC codes, you will find the following new fields which need to be specified for the two-step import:

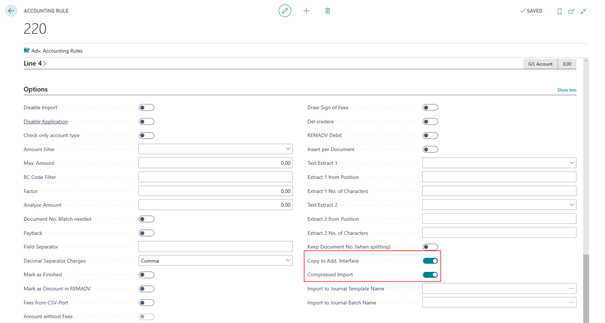

- Copy to Additional Interface

- Compressed Import

If you do not specify these fields, the two-step import will not be performed.

The “Copy to Additional Interface“ field is used in order to consider the new BC code in the lines during entry of the second import register.

The “Compressed Import“ field compresses the values for this BC code. Due to the fact that the individual posting values of the first register usually are not relevant (as they are posted via the second journal), the process of compressions is useful.

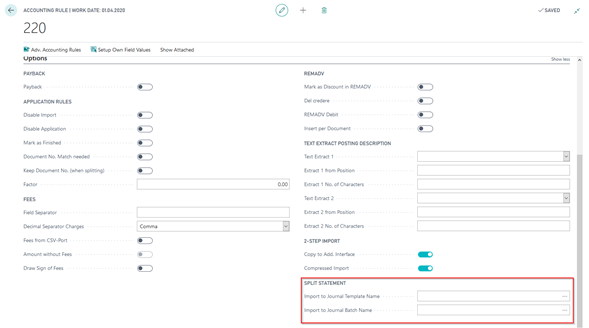

Furthermore, you are offered another option which enables to have certain BC codes copied into specific journals. For example, the vendor-related BC codes of the second register could be copied into a journal which is then processed by the “Accounts Payable“ department.

For this, you need to specify the respective fields in the BC code:

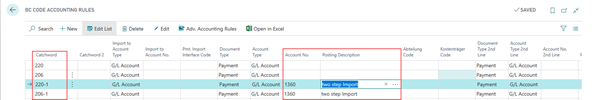

By performing the first import, the BC codes will be duplicated after the setup of import interfaces and BC codes.

This way, you automatically get e. g. in addition to BC code “ 206“ the BC code “206-1“ for the second register.

These new BC codes can be used for accounting of individual positions of the register two.

Once the interfaces have been entirely set up, both import registers must be deleted and the file must be imported again. Subsequently, it is possible to first import and to post the first journal and then to import the second register and to process the applications in a second step.

By using this function only one interface is calculated in the license!