Creating payment templates for direct debits

Payment Templates

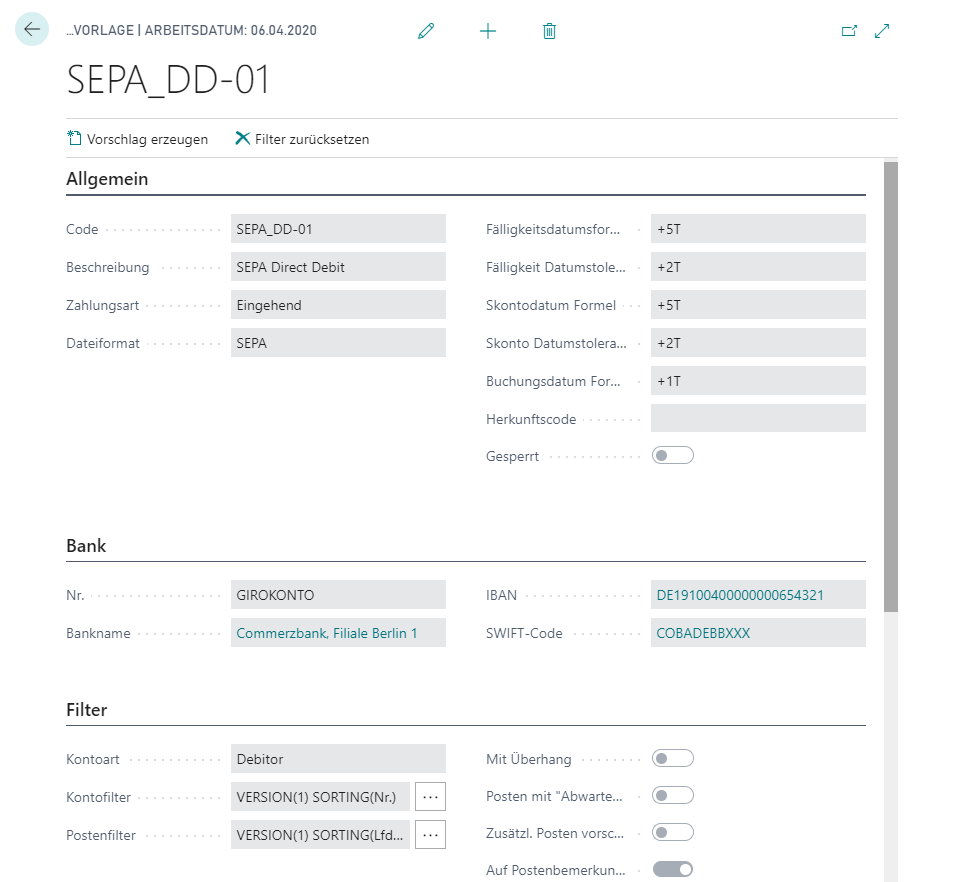

To be able to make direct debits, you need one or more payment templates that contain the most important recurring details and the default values for filter criteria.

Open the Payment Templates overview in the application and create a new payment template using the +New action. Assign a unique code.

Note

ind out the meaning and functions of the individual fields from the tooltips that are stored in the application. The tooltips appear when you move the mouse over the label of the respective field.

Warning

Please make sure that you create a template with the correct Payment Type. For direct debits the payment type is Incoming.

For SEPA direct debits, choose the File Format SEPA.

For the date calculation fields, please use the date formulas provided by the Business Central standard. For example, enter +5T (5 days from work date) if you want to have the customer items suggested that are due in the next 5 days.

Tip

Please take into account that the formulas for date calculation must be selected so that the result date is after the work date. Please coordinate with your house bank regarding the lead times for the execution date.

On the Bank tab, you can define which of your bank accounts should be suggested during file creation.

On the Filter tab you specify, if required, the criteria according to which ledger entries should be suggested when using this payment template. You can set up the filter by account or by ledger entry.

Warning

Please note that overhangs can lead to termination during file generation. Overhangs occur whenever a customer's credit amounts exceed the invoice amounts. Edit proposals that contain an overhang accordingly before file generation.

In the tab SEPA DD you enter further parameters for the selection of the proposed lines. For example, you can specify whether / how credit memos are to be processed, whether the Due Date SEPA is to be overwritten for the direct debit proposal if the original date falls on a national holiday, how fees are to be posted for collection and whether Force Payment Discount is to be used. If you use this function, the payment discount amount contained in the ledger entry will be deducted from the payment amount even if the payment discount period has expired. You can edit this manually. If you leave the payment discount amount set, you decide later in the incoming payment workbook in the column Posting of Difference how to proceed with the difference amount.

Finally, on the Execution tab, select the Archiving Method Workbook to be applied after the processing of the payment suggestion is completed. We recommend setting the Workbook Archiving Method to ArchivingDeleting so that the respective Incoming Payment is moved to the Archived Incoming Payments after the payment file has been created and posted.