Setting up return debits

Return Debit Posting Setup

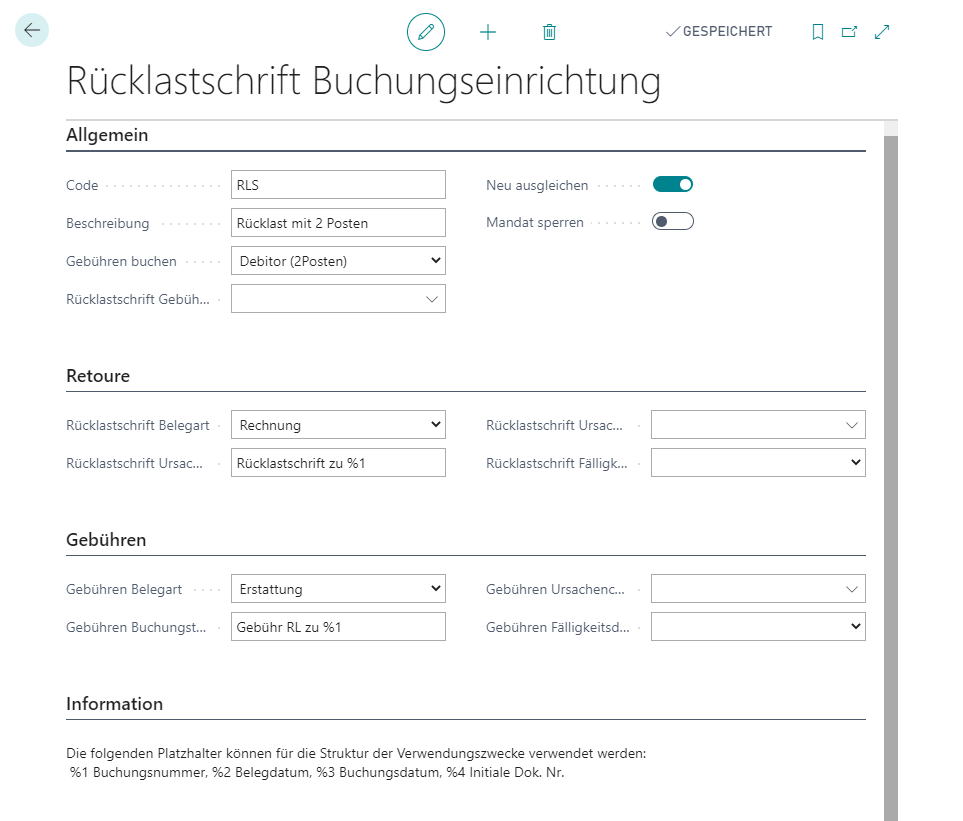

To set up the Return Debit Processing, open the Return Debit Posting Setup list. Via +New you can create a new Returned Debit Posting Setup.

Here you can define how customer ledger entries are to be handled and where any charges incurred are to be posted.

Define a Code and a meaningful Description.

Then specify how the fees are to be posted:

- G/L Account: You define a G/L Account to be posted to in the Retoure Fee Account field.

- Customer (1 entry): A new customer entry is created, consisting of the original payment amount plus the fee.

- Customer (2 entries): Two new customer entries - for the original payment amount and the fee amount - are created.

Then select which Retoure Document Type and which Retoure Document Type should be used for your returns and, if applicable, for the fee entry.

Then define how to proceed with the mandates belonging to the return entries:

You can block the Mandate. This causes the Mandate to become invalid in the event of a return debit and the Blocked by and Blocked by customer entry fields on the Mandate Card to be filled.

Apply New causes the application of the original document to be cancelled and the return debit to be applied with the debit. This means that the original invoice is open again.